Top Mizuho analyst Vijay Rakesh reiterated a Buy rating on Broadcom (AVGO) stock with a price target of $410 following his meeting with the chip company’s management. AVGO stock has rallied more than 46% year-to-date, driven by optimism about the company’s custom AI chips, or ASICs (application-specific integrated circuits). “AVGO remains King of AI Custom Silicon with accelerating ASIC revs and broadening engagement,” said Rakesh.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Top Mizuho Analyst Is Confident About Broadcom’s Growth Prospects

Rakesh discussed some key investor concerns with the management, including Broadcom’s relationship with its fourth AI customer, which Mizuho believes to be OpenAI (PC:OPAIQ), noting that the expected $10 billion in revenue would come from AI Racks, with non-ASIC and networking costs passed through without “margin stacking.”

Assuming XPU (custom ASICs) and networking constitute about 80% of the bill of materials (BOM) and OpenAI Rack revenues of $10 to $24 billion between FY26 and FY28, the analyst estimates gross margin dilution of about 166 basis points (bps) in FY26, 224 bps in FY27, and 286 bps in FY28. Rakesh expects the resulting earnings per share (EPS) impact to be limited, roughly $0.24 to $0.61, or a 3% to 4% adverse impact.

Nonetheless, Rakesh sees the possibility of OpenAI experiencing a faster Titan (the ChatGPT maker’s homegrown chip) ramp in Fiscal 2027 and 2028, as the majority of the XPU team comes from TPU (Tensor Processing Unit) backgrounds, with additional leverage as racks are outsourced to contract manufacturers and original design manufacturers (ODMs).

The 5-star analyst projects Fiscal 2027 and Fiscal 2028 AI revenues at $60 billion and $75 billion, respectively. Rakesh’s estimates are higher than the Street’s forecast of $57 billion and $62 billion for Fiscal 2027 and Fiscal 2028, respectively, with potential upside if Broadcom ramps more AI Racks with future customer wins compared to XPUs and networking products.

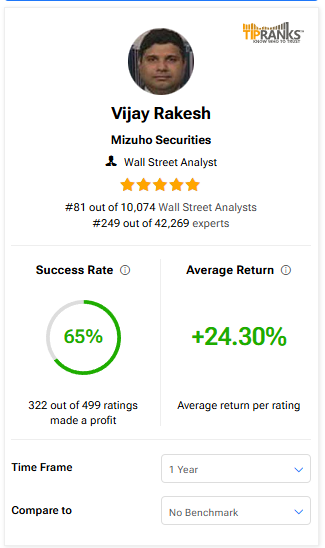

Rakesh ranks No. 81 among more than 10,000 analysts on TipRanks. He has a success rate of 65%, with an average return per rating of 24.3% over a one-year period.

Is AVGO Stock a Good Buy Now?

Currently, Wall Street has a Strong Buy consensus rating on Broadcom stock based on 26 Buys and two Holds. The average AVGO stock price target of $376.42 indicates 11.3% upside potential.