Top Mizuho analyst Vijay Rakesh raised his price target on Intel (INTC) to $39 from $23, while keeping a Neutral rating in a new research report yesterday. The 5-star analyst sees growth drivers in Intel’s advanced chip packaging work and a new CPU deal with Nvidia (NVDA), but remains cautious on the company’s core business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Why Rakesh Ups His Price Target

Rakesh said Intel’s advanced packaging segment could add about $1.5 billion in annual revenue starting between 2026 and 2027. He believes Intel is in a good spot to capture share as more chipmakers adopt advanced packaging for next-gen AI and data chips.

The analyst also pointed to Intel’s growing link with Nvidia. He estimates the Nvidia CPU ramp could lift Intel’s topline by another $4 billion per year by 2029, building on its current $50 billion revenue base.

Intel’s Challenges Still Run Deep

While partner investments could help improve sentiment, Rakesh warned that Intel still faces major hurdles. He said the company is losing share in servers, lacks a clear AI roadmap, and its 18A process may still depend on TSMC (TSM), which could pressure margins.

Is Intel a Buy, Hold or Sell?

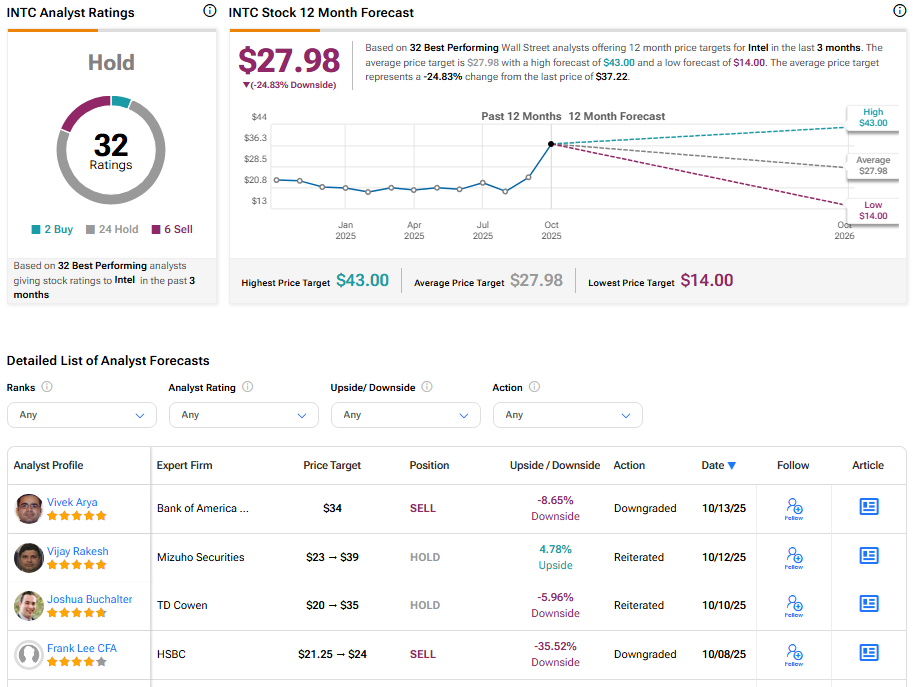

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 27 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. After a 55.16% rally in its share price over the past year, the average INTC price target of $27.98 per share implies a 23.80% downside risk.