Five-star analyst from KeyBanc, John Vinh, has downgraded Advanced Micro Devices (AMD) stock’s rating to Hold from Buy. This move is driven by concerns over the semiconductor giant’s artificial intelligence (AI) business in China, strong competition, and rising pressure on its gross margins.

The downgrade follows a major decline in AMD’s stock value, which has fallen over 50% in the past year, including a sharp 19% drop in the last week alone.

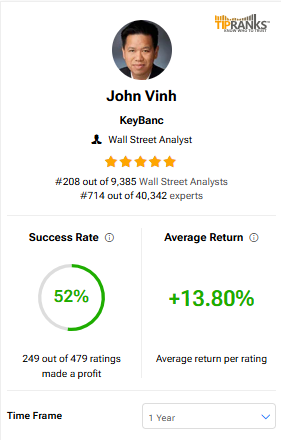

Before moving ahead, it must be noted that Vinh ranks 208 out of more than 9,300 analysts tracked by TipRanks. He has a success rate of 52% and has achieved an average return per rating of 13.8% in the past year.

Top Analyst Flags Concerns Over AMD’s China Prospects, Margins

Among the key concerns, Vinh highlighted the sustainability of AMD’s AI-related demand in China, which faces risks from export restrictions and geopolitical tensions.

Another major factor in the analyst’s cautious stance is the potential pressure on AMD’s gross margins stemming from Intel’s (INTC) aggressive pricing strategies. Vinh believes this could potentially lead to a price war that could further strain AMD’s margins.

Further, the analyst noted that AMD has limited opportunities to gain market share in the server and PC segments, especially as Intel makes progress with its 18A process node.

Although AMD’s stock looks fairly cheap at 13 times KeyBanc’s expected earnings for 2026, Vinh warned that semiconductor stocks usually struggle when profit margins are under pressure.

Analyst Raises AMD’s Forecasts

Despite the downgrade, the Top analyst noted positive developments for AMD. Vinh has raised his revenue and EPS forecasts for the company, citing stronger-than-expected demand for its MI308 AI accelerator and a rebound in personal computer orders.

Is AMD a Buy, Hold, or Sell?

Turning to Wall Street, AMD stock has a Moderate Buy consensus rating based on 24 Buys and 12 Holds assigned in the last three months. At $148.10, the average AMD price target implies a 77.07% upside potential.