Top investor Juxtaposed Ideas recently upgraded Archer Aviation (ACHR) to a Buy, pointing to clearer revenue paths before full commercial launch. In simple terms, the view is that Archer no longer depends only on future air taxi rides.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

First, Archer plans to license its powertrain technology to third parties. This includes defense-focused partners such as Anduril Industries. According to Juxtaposed Ideas, licensing could bring steady and high-margin revenue as early as 2026. As a result, Archer may begin generating meaningful revenue even before FAA approval for passenger flights.

Next, the analyst highlights the Hawthorne Airport deal near Los Angeles. This airport already generates profit from leases and services. Therefore, it could add revenue sooner while also acting as a key hub once flights begin. Over time, this may support a faster rollout once certification is complete.

Valuation Improves Despite Ongoing Risks

Meanwhile, the top investor notes that Archer shares are down about 44% from recent highs. Due to this drop, valuation now looks more attractive compared with peers. Using long-term estimates, Archer trades at much lower EV-to-sales levels than Joby Aviation (JOBY).

In addition, Archer holds a large cash balance of over $2 billion. This gives the company room to fund testing and production without urgent pressure. As a result, the balance sheet reduces near-term risk tied to delays.

Still, the analysis also flags key risks. Archer remains unprofitable and may raise more capital. This could lead to dilution and price swings. Short interest is also high, which adds volatility.

Overall, the top investor views Archer as suitable only for patient investors with high risk tolerance. The upgrade reflects better timing and structure, not a change in the long road to mass service.

Is Archer Aviation Stock a Good Buy?

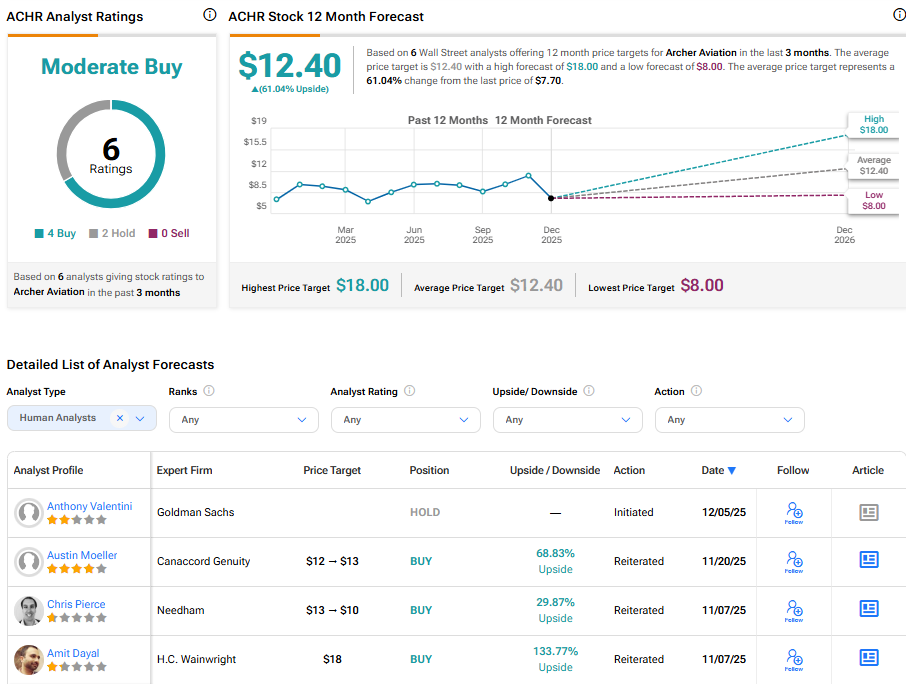

Despite volatility in Archer’s shares in 2025, Street analysts remain optimistic about the company’s prospects. Based on six recent ratings, Archer Aviation boasts a “Moderate Buy” consensus with an average ACHR stock price target of $12.40. This implies a 61.04% upside from the current price.