Top Evercore analyst Mark Mahaney reiterated a Buy rating on Netflix (NFLX) stock with a price target of $1,375, citing favorable trends indicated by his firm’s recent U.S. and Mexico surveys. Netflix stock has risen over 37% year-to-date, as the streaming giant continues to impress investors with its strong financial performance despite intense competition.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Top Evercore Analyst Is Upbeat on Netflix Stock

Mahaney noted that core Netflix trends in the U.S. remain largely positive, with favorable penetration and satisfaction metrics, but weaker trends in churn intent among subscribers. The 5-star analyst also noted that Netflix continues to show resilience in terms of core satisfaction and global content leadership, with international markets, notably Mexico, posting record penetration and historically low churn rates.

Overall, Evercore’s surveys, channel checks, and model sensitivity analysis indicate that Netflix is positioned for sustained mid-20s percentage growth in earnings per share (EPS) through 2028.

Mahaney continues to view NFLX as the strongest financial and competitive streaming franchise, with live events and advertising revenue presenting long-term, significant new growth catalysts.

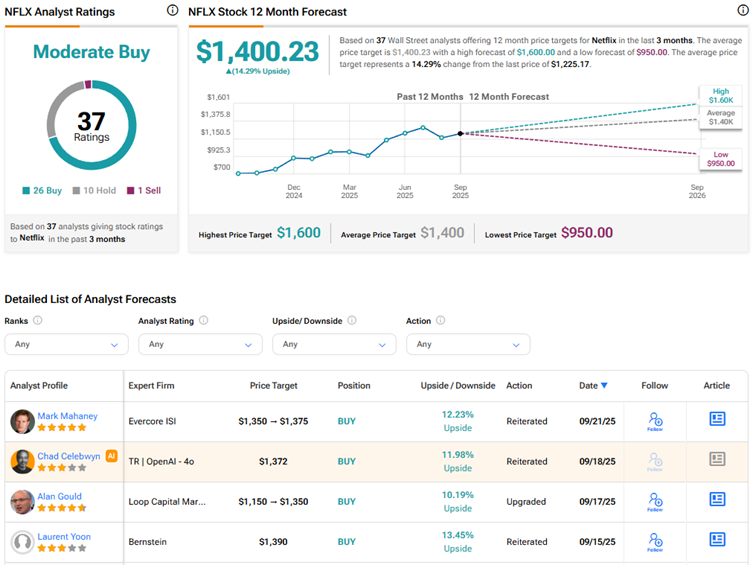

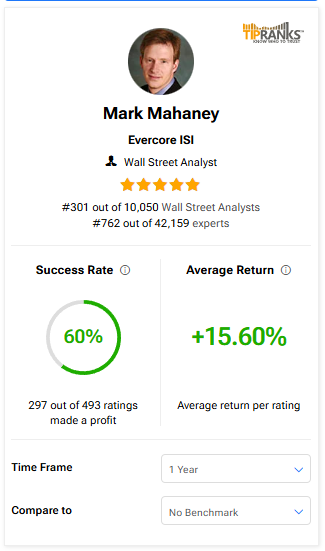

Interestingly, Mahaney ranks No. 301 among more than 10,000 analysts on TipRanks. He has a success rate of 60% with an average return per rating of 15.60% over the past year.

Is NFLX Stock a Good Buy?

Overall, Wall Street has a Moderate Buy consensus rating on Netflix stock based on 26 Buys, 10 Holds, and one Sell recommendation. The average NFLX stock price target of $1,400.23 indicates 14.3% upside potential from current levels.