As crypto markets go through a correction, investors are searching for projects and tokens that have sustainable business models, generate revenues and dividends that can drive demand from institutional investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s call them ‘value’ picks, akin to value stocks in equity markets.

For much of its history, crypto markets had been driven by hype and speculation – MEME coins, narrative trades, and quick boom-and-bust cycles.

But the industry is maturing and 2025 marked the beginning of a shift where token value is increasingly tied to real fundamentals: revenue, dividends, buybacks, treasury demand, and regulated ETFs.

This mirrors the evolution of equity markets: revenue growth, earnings, dividends, and share buybacks became the anchors of valuation.

Now, the same is happening in crypto. Interestingly, there is a growing phenomenon of stocks that engage in the buying, selling and/or storage of Crypto. Examples of these stocks include Coinbase (COIN), Etoro (ETOR), Strategy (MSTR), Circle (CRCL), Bullish (BLSH), and Gemini (GEMI).

From Narratives to Fundamentals

In traditional finance, investors reward companies that generate revenues, growth, earnings and dividends, and manage their balance sheets responsibly. Crypto tokens are beginning to reflect the same:

- Revenue generating, low valuation tokens are like ‘Value’ stocks.

- Revenue-sharing tokens act like dividend stocks. Protocols distribute part of their fees to holders.

- Buyback-and-burn models are crypto’s version of stock repurchases. Revenues fund token buybacks, shrinking supply.

- Digital Asset Treasuries (DATs) and ETFs mirror institutional asset allocations, creating persistent demand.

These dynamics transform tokens from speculative chips into assets with measurable yield and scarcity.

1. Revenue-Generating, Low Valuation Tokens: Crypto’s ‘Value’ stocks

Much like in the traditional stock markets, revenue size and growth are signals to investors that the project provides strong value to its end users (customers).

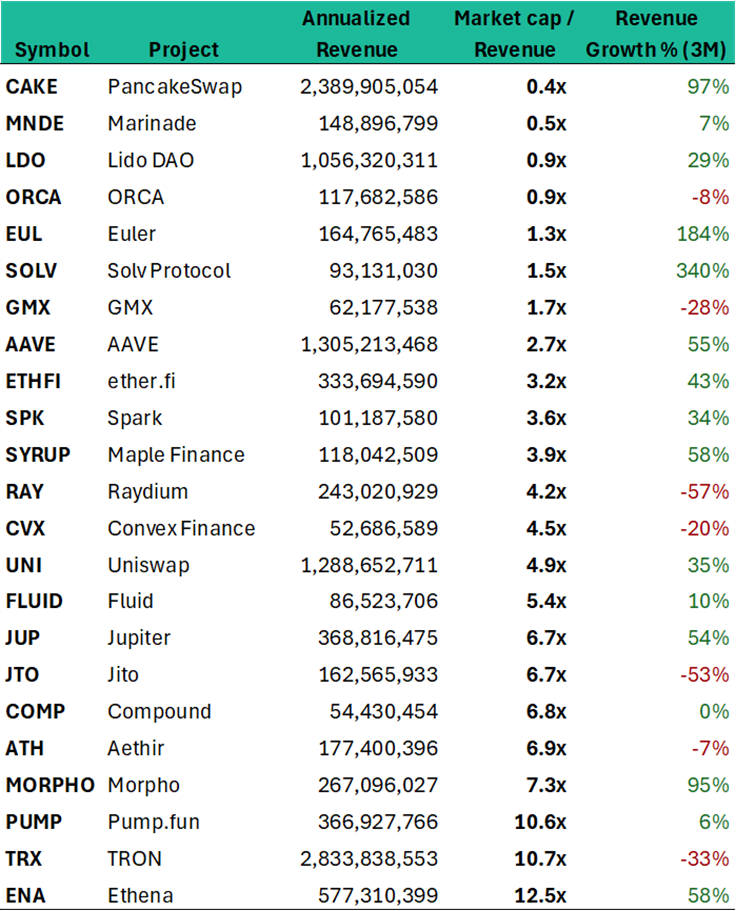

Here’s a list of crypto projects with annualized revenue greater than $50 million, ordered by valuation ratio (Market cap / Revenue) sourced from altFINS.

This valuation metric — already standard in equity analysis (P/S) — allows investors to identify which tokens are “cheap” relative to their sales (revenue).

Tokens With High Revenue And Low Valuation

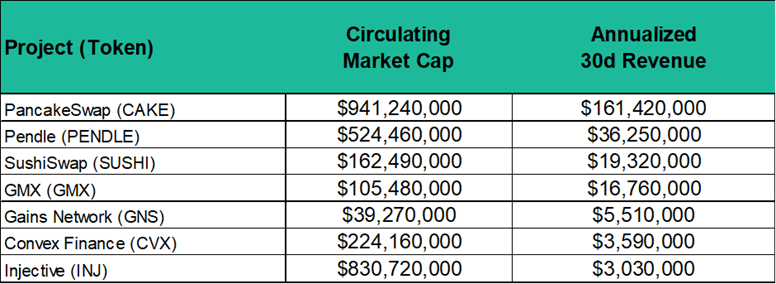

2. Revenue-Sharing Tokens: Crypto’s Dividends

Investors like dividends.

Crypto investors are no different and some DeFi projects share revenues with their token holders including:

3. Buybacks and Burns: Deflationary Tokenomics

Buyback programs are increasingly being implemented as a way to reward token holders.

Sustainable buybacks funded by revenues (like Aave or TRON) create long-term value, while one-off treasury burns provide only temporary boosts.

- PancakeSwap (CAKE) burns ~345% of its FDV annually (gross) — one of the most aggressive programs in crypto.

- Raydium (RAY) repurchased ~$54M worth of tokens in a single month, removing 10% of its float.

- TRON (TRX) continuously burns ~1.1–1.2 billion TRX per month, equal to ~15% of supply annually.

- Aave (AAVE) runs steady $1M weekly buybacks from protocol fees.

Token Buyback Programs

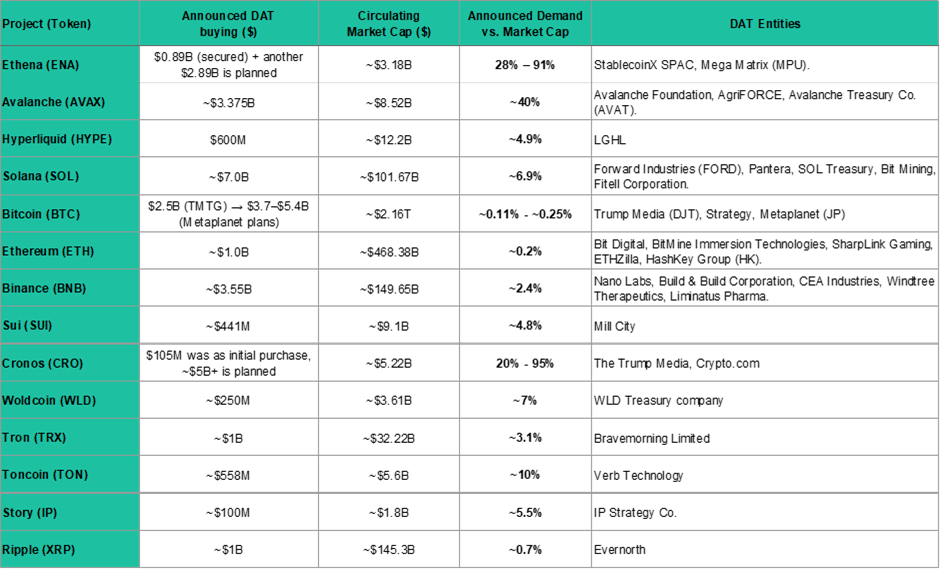

4. Digital Asset Treasuries (DATs): Institutional Balance Sheets Go Crypto

DATs are corporate vehicles raising billions to accumulate crypto. This model was pioneered by Michael Saylor at Strategy (MSTR, formerly Microstrategy), accumulating BTC. They are public companies holding large stockpiles of Bitcoin or Ethereum — but now extend to altcoins.

Unlike speculative trading, DAT accumulation is programmatic — providing weeks or months of steady bid support.

- Avalanche (AVAX): $3.3B in announced DAT accumulation (~25% of its market cap).

- Ethena (ENA): DAT with $890M already secured, with up to $2.9B planned — potentially absorbing 18–78% of supply.

- Cronos (CRO): Trump Media and Crypto.com partnership could see $5B worth of CRO absorbed, nearly equal to its market cap.

- Solana (SOL): Over $7B in DAT demand announced — enough to shift medium-term supply/demand balance.

DAT Demand Outlook

5. ETFs: Mainstream Onramp

ETFs are the bridge that allows traditional investors to access crypto through regulated markets.

- Bitcoin (BTC): Spot ETFs live since Jan 2024, representing 6.6% of BTC supply worth $141B.

- Ethereum (ETH): Spot ETFs launched mid-2025, representing 5.1% of ETH supply worth $23B.

- Solana (SOL): Multiple U.S. ETF filings in late 2025, with Canada’s ETFs already trading.

- Avalanche (AVAX): VanEck has filed for a U.S. spot ETF.

- XRP, AAVE, SUI: Surprisingly, all are now on the ETF radar

.

ETFs don’t just boost liquidity — they validate tokens as long-term investment assets.

What This Means for Investors

The crypto market is converging with traditional finance in how value accrues:

- Revenue-sharing tokens (AAVE, COMP, ENA) = dividends.

- Buyback-and-burn models (CAKE, RAY, TRX) = stock buybacks.

- DAT accumulation (AVAX, SOL, CRO) = institutional treasuries.

- ETFs (BTC, ETH, SOL, XRP, AVAX) = regulated access for global capital.

This shift signals the beginning of a fundamentals-driven repricing cycle. Tokens with cash flows, deflationary supply, and institutional demand are set to outperform purely narrative-driven assets.

The Takeaway

For TipRanks readers familiar with equity investing, the parallels are clear: revenue growth, dividends, buybacks, and institutional (“smart money”) allocations are among key drivers of valuations.

Crypto is now entering the same phase.

The winners of the next cycle will not be the loudest MEME coins but projects combining fundamental yield, deflationary supply mechanics, and institutional adoption — with Avalanche (AVAX), Solana (SOL), Aave (AAVE), TRON (TRX), and Ethena (ENA) among the most compelling examples.

Top Tokens – Value Drivers Matrix

About altFINS

altFINS is a crypto analytics and research platform that helps traders and investors find trading and investment ideas. It was rated the Best Crypto Screener. altFINS tracks data from more than 30 exchanges and 120 technical indicators, while publishing exclusive fundamental research on token fundamentals (Coin Pick), whale and smart money insights, and comparative valuation analyses.By combining deep research with analytical tools, altFINS bridges the gap between crypto-native analysis and institutional investing frameworks, making it easier for both professional and retail investors to understand where real value is accruing in the digital asset market.