Ahead of iPhone maker Apple’s (AAPL) results for the first quarter of Fiscal 2026 on January 29, top Bank of America analyst Wamsi Mohan reaffirmed a Buy rating on AAPL stock with a price target of $325. The analyst expects Apple to deliver “upside” to the Street’s estimates, driven by continued strength in iPhone sales and double-digit growth in the company’s Services revenue.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Wall Street expects Apple’s Q1 FY26 earnings per share (EPS) to rise 11.5% to $2.67. Analysts expect revenue to grow by 10.5% year-over-year to $137.41 billion.

Top Analyst Is Optimistic About Apple’s Q1 FY26 Earnings

Mohan expects Apple to report Q1 FY26 revenue and EPS of $140 billion and $2.69, respectively, compared to Wall Street’s consensus estimates. While the 5-star analyst expects Apple to report Q1 FY26 gross margin of 47.5% (at the midpoint of guidance), he expects a quarter-over-quarter improvement in the fiscal second-quarter gross margin, driven by a higher mix of Services business.

Coming to the Q2 FY26 outlook, Mohan expects Apple to project Q2 FY26 revenue and EPS of $105 billion and $1.82, respectively, compared to the Street’s estimates of $105 billion and $1.85. Additionally, he expects the company to guide Q2 FY26 gross margin in the range of 47.5% to 48.5%.

Mohan sees the possibility of further upgrades, supported by the launch of a foldable iPhone in the fall and the rollout of enhanced Siri in collaboration with Alphabet-owned Google’s (GOOGL) Gemini AI.

While AAPL stock has been under pressure so far this year due to investor concerns about higher memory costs, Mohan expects the company to gain from robust iPhone demand and double-digit year-over-year revenue growth in the Services unit, despite weaker App Store sales in China. “Apple remains underweight in investor portfolios, which we see reversing this year,” concluded Mohan.

Is AAPL Stock a Buy, Sell, or Hold Now?

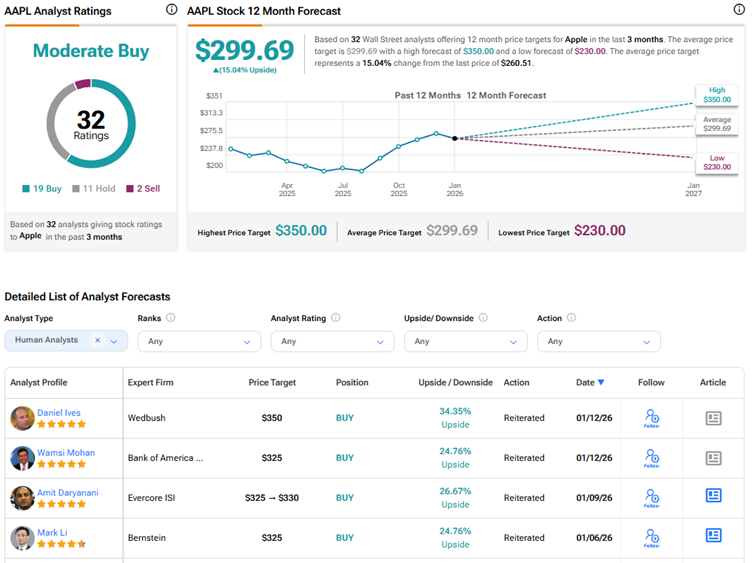

Currently, Wall Street has a Moderate Buy consensus rating on Apple stock based on 19 Buys, 11 Holds, and two Sell recommendations. The average AAPL stock price target of $299.69 suggests 15% upside potential.