Social media giant Meta Platforms (META) is scheduled to announce its third-quarter results on Wednesday, October 29. Ahead of Q3 earnings, top Bank of America analyst Justin Post reiterated a Buy rating on META stock with a price target of $900, saying that he is “looking for revenue beat to support AI investment returns.” META stock has risen 25% year-to-date, driven by the company’s solid fundamentals and optimism about its artificial intelligence (AI) initiatives.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wall Street expects Meta Platforms to report earnings per share (EPS) of $6.69, reflecting an 11% year-over-year growth. Meanwhile, revenue is estimated to grow by 21.6% to $49.4 billion.

Top Analyst Expects Meta Platforms to Deliver Q3 Beat

Post expects Meta Platforms to report Q3 revenue and EPS of $50 billion and $7.30, with both of his estimates higher than the Street’s consensus expectations. The 5-star analyst’s checks indicate potential upside, driven by improving macro backdrop, accelerating AI benefits, and higher sector ad spend to “backfill” subdued organic Google (GOOGL) traffic. Meanwhile, Post expects Q3 operating margin to decline by 49 basis points year-over-year to 42.3% due to continued investments.

The top-rated analyst believes that yet another quarter of robust ad growth and outlook could help bolster investors’ confidence in the durability of Meta Platforms’ AI ad engine. For Q4 2025, Post expects revenue and EPS of $58.8 billion and $8.90, respectively, higher than the Street’s estimates of $57.3 billion and $8.12. Assuming Q3 revenue at the high end of the guidance, Post expects Meta to issue a Q4 revenue outlook in the range of $55.5 billion to $59 billion, reflecting 15% to 22% year-over-year growth.

Additionally, Post believes that investors will focus on Meta Platforms’ progress on its AI roadmap. Given reports of additional AI hiring, potential large language model (LLM) and infrastructure deals, and OpenAI (PC:OPAIQ) social competition, the analyst thinks that updates on META’s AI outlook will be in focus during the earnings call and vital for investor sentiment. Post highlighted that at the current valuation of 23x 2026 EPS (compared to the historical average of 21x), META stock appears attractive, given AI assets and the early stage of AI monetization opportunity.

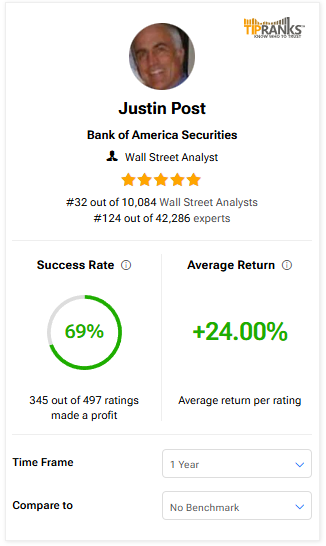

Interestingly, Post ranks No. 32 among more than 10,000 analysts on TipRanks. He has a success rate of 69%, with an average return per rating of 24% over a one-year period.

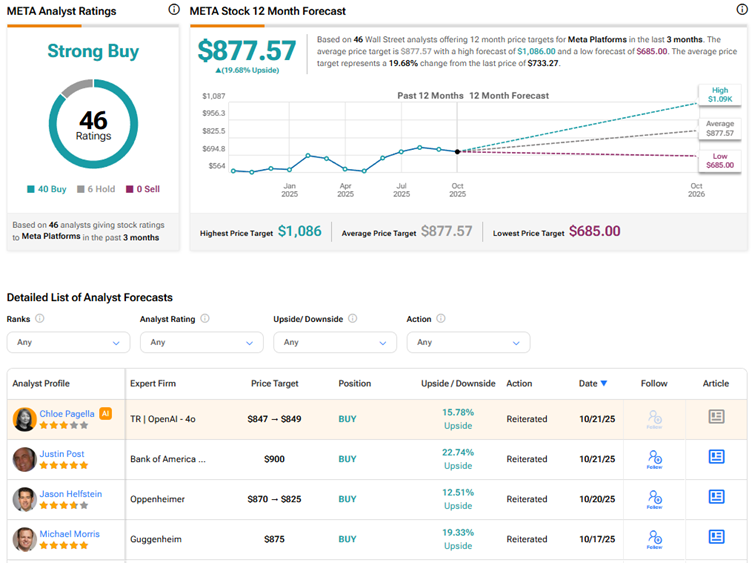

What Is the Price Target for META Stock?

Currently, Wall Street has a Strong Buy consensus rating on Meta Platforms stock based on 40 Buys and six Holds. The average META stock price target of $877.57 indicates about 20% upside potential from current levels.