Top Bank of America analyst Vivek Arya increased his price target for chipmaker Advanced Micro Devices (AMD) stock to $300 from $250 and reiterated a Buy rating, citing positive announcements at the 2025 Open Compute Project, or OCP Global Summit. In particular, Arya now sees greater visibility into the deployment and ramp outlook of the MI450 Series “Helios” rack-scale AI hardware platform.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, the Helios rack-scale AI accelerators are expected to bolster AMD’s positioning in the high-performance computing (HPC) and AI training market, which is currently dominated by Nvidia (NVDA).

Top Analyst Is Upbeat on AMD’s AI Growth Story

Arya is optimistic about AMD’s Helios offering, expected to be launched in the second half of 2026, supported by key industry customers such as Oracle (ORCL), Meta Platforms (META), and ChatGPT maker OpenAI (PC:OPAIQ).

The 5-star analyst now assumes that AMD will capture 50% of the OpenAI deal’s planned 6 gigawatt GPU (graphics processing units) deployment over four years, beginning with a 1 GW ramp in late 2026. This reflects $1.4 billion and $9.7 billion of additional sales in 2026 and 2027, respectively, with potential earnings per share (EPS) of $10 to $11 by 2027, if 100% of the deal materializes.

Furthermore, Arya noted that Advanced Micro Devices is now behind all major open-standard AI networking ecosystems. He is also encouraged by the fact that the semiconductor giant is now “supporting an ecosystem that is vendor-agnostic across CPU, accelerators, NICs, and switches.”

Additionally, Arya highlighted that within both the PC and server central processing unit (CPU) spaces, Advanced Micro Devices continues to maintain a strong competitive position against Intel (INTC). He added that over the last few years, INTC has consistently lost share in both product categories, mainly due to products that have fallen behind in manufacturing node compared to AMD and ARM-based competitors, who generally utilize TSMC’s (TSM) N or N-1 latest nodes.

Is AMD Stock a Buy or Sell?

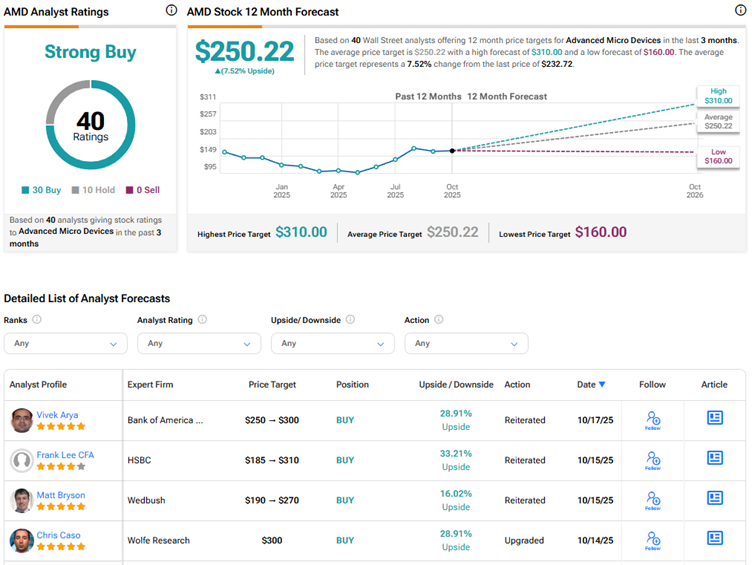

With 30 Buys and 10 Holds, Advanced Micro Devices stock scores a Strong Buy consensus rating. The average AMD stock price target of $250.22 indicates 7.5% upside potential from current levels. AMD stock has rallied about 92% year-to-date.