CoreWeave (CRWV) stock is up about 12% on Tuesday after the AI infrastructure provider disclosed a $14 billion deal with Meta Platforms (META). Following the deal, Evercore ISI analyst Amit Daryanani initiated coverage with a Buy rating and a bullish $175 price target. Daryanani’s bullish view stands in contrast to DA Davidson analyst Gil Luria, who reiterated a Sell rating and a much more cautious $36 price target.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at the opinions of these Top analysts.

Daryanani Sees CRWV Benefiting from AI Boom

The five-star analyst believes CoreWeave is well-positioned to become a leading provider of AI infrastructure services, not just for AI-native companies but also for traditional businesses building AI tools.

He noted that the company’s custom-built systems offer better performance and lower costs than big cloud providers, with over 20% efficiency gains in model processing. Also, the analyst highlighted CRWV’s accelerating revenue growth and strong backlog.

Further, Daryanani stated that demand for AI infrastructure is much higher than supply, which could boost CoreWeave’s revenue. At the same time, lower interest rates are expected to reduce the cost of building and running its systems, further supporting margin expansion.

While acknowledging near-term volatility, Daryanani said, “there’s higher probability CRWV is able to sustain and scale their differentiation from training to inferencing as they benefit from running an “at scale AI-as-a-service” for customers beyond the current cohort.”

Luria Flags Risks in CoreWeave’s Customer Base

On the other hand, Luria raised concerns about CoreWeave’s heavy reliance on OpenAI, especially after OpenAI committed nearly $500 billion to other providers, such as Oracle (ORCL).

While the deal with Meta helps diversify CRWV’s customer base, Luria is still unsure about the strength of its backlog and long-term outlook.

Is CRWV a Good Stock to Buy?

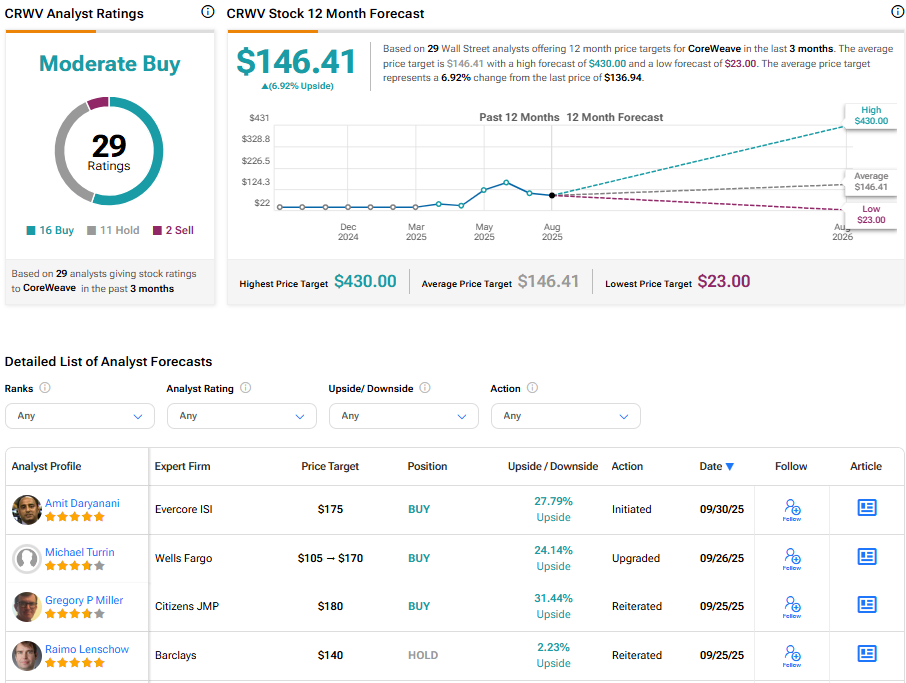

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CRWV stock based on 16 Buys, 11 Holds, and two Sells assigned in the past three months. Further, the average CoreWeave stock price target of $146.41 per share implies 6.9% upside potential.