This article was written by Shalu Saraf and reviewed by Gilan Miller-Gertz.

As investors shift from AI excitement to real returns, analysts are looking closely at which companies can turn AI demand into steady profits. After Nvidia’s CES 2026 keynote speech, two major firms — BofA Securities and Evercore ISI — said NVIDIA (NVDA) remains one of the strongest AI stocks heading into 2026.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BofA Securities: AI Demand Remains “Very High”

Top BofA Securities analyst Vivek Arya reiterated a Buy rating with a $275 price target, calling Nvidia his “top AI pick.” It is worth noting that Arya ranks 228 out of more than 10,000 analysts tracked by TipRanks. He has a success rate of 60%, with an average return per rating of 118% over a one-year timeframe.

Five-star analyst Arya said Nvidia’s management made it clear that demand for AI computing is still very strong. He pointed to steady gains in AI efficiency, with systems producing more output each year while costs continue to fall. In his view, this supports wider and longer-term use of AI.

At the same time, Arya highlighted Nvidia’s upcoming Vera Rubin platform, which is expected to launch in the second half of 2026. The platform will include several new AI chips and a stronger memory setup designed to handle larger workloads.

Beyond new products, Arya said Nvidia’s wide reach across AI remains a key strength. Management noted that every major large language model today runs on Nvidia systems. He also said AI is moving beyond language models into real-world uses, such as self-driving systems, which could drive more demand over time.

From a valuation view, Arya said Nvidia trades near the broader market, even though earnings and cash flow are expected to grow much faster. That gap supports his positive outlook on the stock.

Evercore ISI: Nvidia Is at the Center of the AI Shift

Another five-star analyst, Mark Lipacis of Evercore ISI also reiterated an Outperform rating with a Street-high price target of $352 per share, calling Nvidia a “Top Pick for 2026” after the CES event. Notably, Lipacis ranks 44th among more than 10,000 analysts tracked by TipRanks, with a 67% success rate and an average 27% return per rating over one year.

Lipacis said Nvidia is well placed as computing shifts toward “parallel processing,” where many tasks are handled at the same time instead of one after another. He sees this as a long-term change that fits well with Nvidia’s strengths.

Just as importantly, Lipacis pointed to Nvidia’s broad ecosystem. Because its hardware and software work across many AI models, customers can keep costs lower as AI tools evolve. As a result, he believes Nvidia could capture 70% to 80% of the value created in AI over time.

Is NVDA a Good Stock to Buy Now?

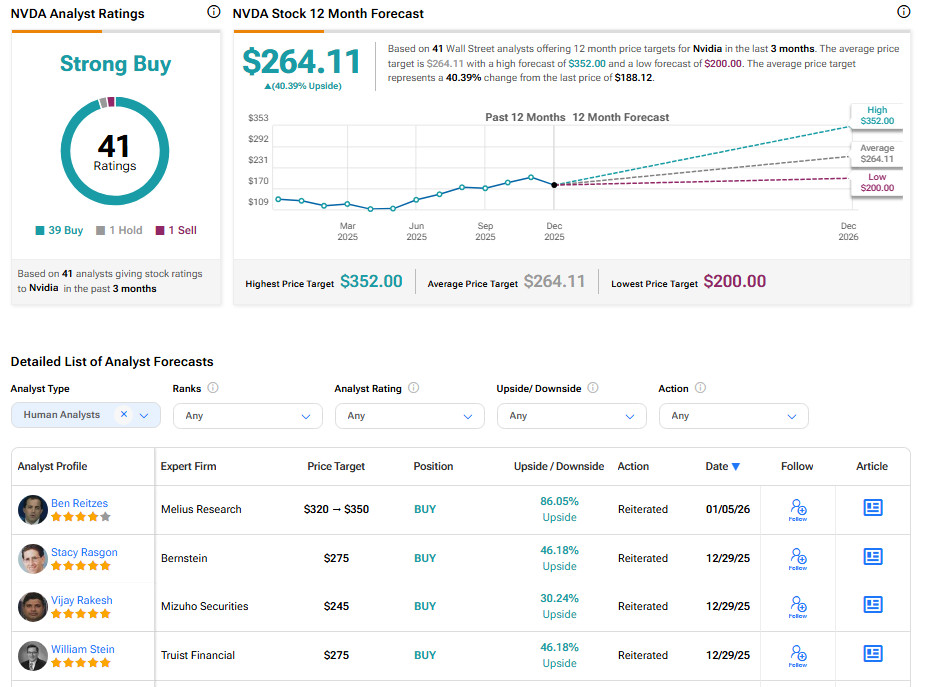

According to TipRanks, NVDA stock has a Strong Buy consensus rating based on 39 Buys, one Hold, and one Sell assigned in the last three months. At $264.11, Nvidia’s average share price target implies a 40% upside potential.