Joel Fishbein, a top analyst from Truist Financial, upgraded ServiceNow (NOW) stock to Buy from Hold, calling the enterprise workflow automation platform a “rare compounder.” The 5-star analyst boosted the price target for NOW stock to $1,200 from $950, reflecting an upside potential of more than 25%. This marks the second rating upgrade to Buy for NOW stock (Erste Group upgraded to Buy on April 30) following its market-beating results for the first quarter of 2025.

ServiceNow stock rallied more than 15% on April 24, as the company impressed investors with an 18.5% growth in revenue as well as adjusted EPS (earnings per share) and issued an upbeat outlook for the second quarter despite macro uncertainty.

Here’s Why Truist Turned Bullish on ServiceNow Stock

Truist’s Fishbein turned bullish on ServiceNow stock, as he believes that the company will continue to consolidate the enterprise IT stack, while leveraging AI and macro uncertainty to bolster its relative positioning compared to its peers.

He views NOW as a “rare compounder” that will be able to capitalize on its platform architecture to drive consistent growth by both upselling and cross-selling its products. Fishbein highlighted that the expanding breadth of ServiceNow’s offerings into established verticals, like CRM (customer relationship management), and emerging ones, like agentic AI, has the potential to drive durable growth. Further, the analyst sees the company’s go-to-market (GTM) execution track record as the “gold standard” in Truist’s coverage.

The analyst also pointed out NOW’s dominant position in the AI space, noting that industry feedback over the last year indicates a trend towards buying pre-built AI tools rather than developing in-house solutions. Despite the post-earnings jump, NOW stock is still down about 10% year-to-date. Fishbein sees the pullback in the stock as an attractive opportunity to buy additional shares.

Fishbein ranks 211 out of more than 9,400 analysts on TipRanks. He has a success rate of 57%, with an average return per rating of 14.30%.

Is ServiceNow Stock a Good Buy?

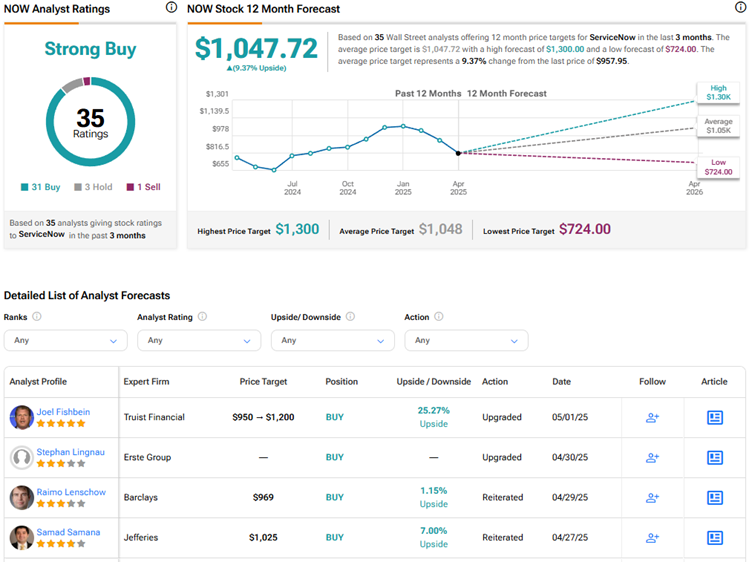

Overall, Wall Street is bullish on ServiceNow stock, with a Strong Buy consensus rating based on 31 Buys, three Holds, and one Sell recommendation. The average NOW stock price target of $1,047.72 implies 9.4% upside potential from current levels.