Nvidia (NVDA) stock pulled back by 5% on Thursday morning, reflecting broader market volatility and renewed trade tensions between the U.S. and China. Investor sentiment took a hit after the U.S. announced tariffs of up to 145% on some Chinese imports. As a result, big tech stocks fell across the board, with the Nasdaq 100 (QQQ) dropping over 4%. Despite these tariff concerns, Morgan Stanley analyst Joseph Moore maintained a bullish stance on Nvidia stock.

The Top analyst reiterated a Buy (equivalent to Overweight) rating on the stock and maintained a price target of $162 per share, which implies a nearly 50.6% upside potential from current levels. It is worth noting that Moore ranks 439 out of more than 9,373 analysts tracked by TipRanks. He has a success rate of 52%, with an average return per rating of 9.8% over a one-year timeframe.

Moore’s Views on NVDA Stock

Despite all the noise around tariffs and rising trade tensions, Morgan Stanley’s Joseph Moore still sees Nvidia as one of the top players in the chip space. With demand for AI chips soaring and Nvidia’s dominant role in supplying the GPUs that power this boom, Moore thinks the company is in a strong position to keep leading the charge.

He also pointed to Nvidia’s smart manufacturing strategy—especially its move to expand production in North America—as an extra layer of protection. These steps, Moore believes, help reduce exposure to international risks and give the company more control in an uncertain global environment.

Still, the analyst isn’t ignoring the ongoing tariff risks. While tensions may have cooled slightly, he clarified that “this is not over.” Nvidia might be insulated from immediate damage, thanks to strong near-term demand, but the bigger picture still has some red flags. The base 10% tariff remains in place and could climb higher within 90 days. And although semiconductors are currently spared from China’s retaliatory tariffs, the situation is far from settled. Moore cautioned that the broader impact of tariffs, especially on financing and future investments, could still weigh on the sector.

Is NVDA a Good Buy?

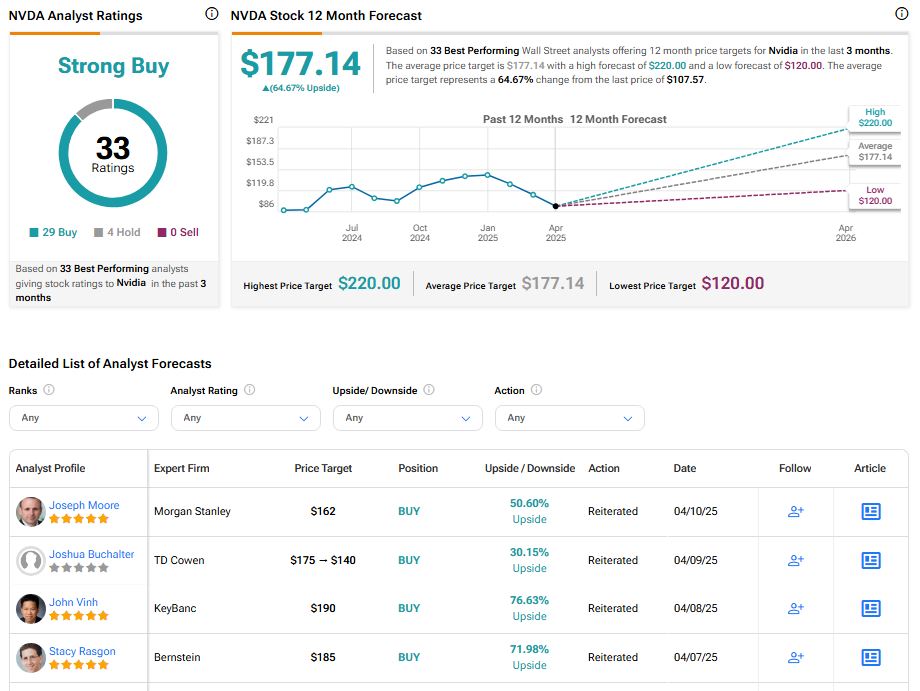

Overall, Wall Street remains bullish with a Strong Buy consensus rating on NVDA, based on 29 Buys and four Holds. The average NVDA price target of $177.14 implies 64.67% upside after the stock took a beating this week.