A week that started off well for Alphabet (NASDAQ:GOOGL) stock ended on a disconcerting note Friday.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

On Monday, multiple news outlets reported that Apple is in talks to incorporate Google’s Gemini artificial intelligence tools into future iPhones, mimicking a move by Apple rival Samsung in January, which inked a deal to install Gemini on Galaxy S24 smartphones, and building on an established relationship between Apple and Alphabet, that makes Google the default search engine on Apple’s Safari browser. That news sent Alphabet stock up 4% to start off the week.

On Friday, however, news of a different sort broke: Turns out, Apple is also in talks with China’s Baidu, to use its AI (named “Ernie Bot”) on Apple devices sold in China. This news, if it pans out, would seem likely to diminish the importance of the Apple-Alphabet alliance rumored earlier in the week if it means that iPhones sold in China will not be contributing licensing revenue to Alphabet. Yet, despite this risk, Alphabet managed to close out the week with another gain – 2% – on Friday.

So how did Alphabet manage that?

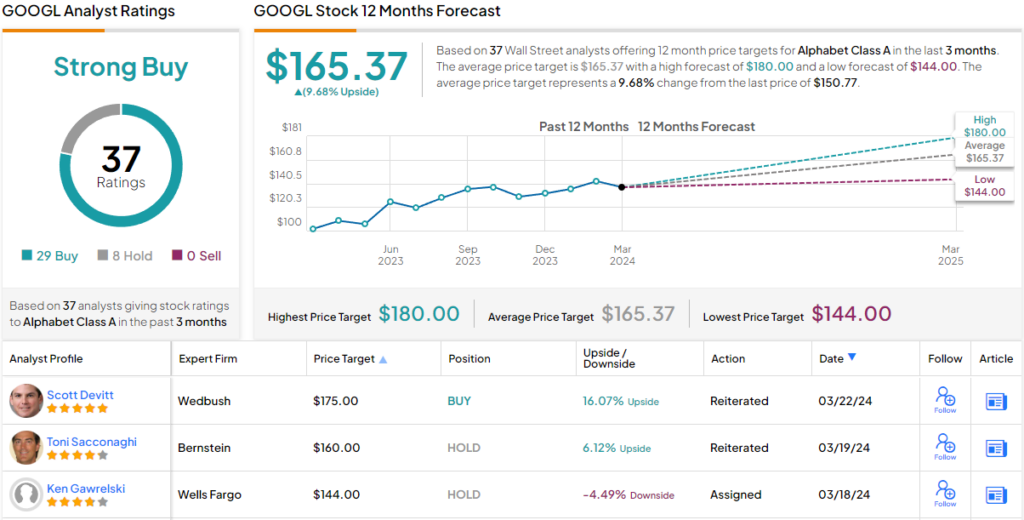

Credit may go to investment bank Wedbush on this one. Friday’s other big Alphabet news, you see, was that Wedbush’s Scott Devitt, a 5-star analyst rated in the top 4% of the Street’s stock pros, named Alphabet one of Wedbush’s “best ideas,” and raised his price target on the stock to $175 a share. (To watch Devitt’s track record, click here)

Baidu competition or no, Dewitt is of the opinion that “the perceived structural risks to Google Search are overstated,” while at the same time the company’s opportunities in generative artificial intelligence may be bigger than many investors realize. Alphabet, argues Dewitt, “has an unmatched breadth of data to develop and train AI models across text, images, and video, a massive user base spanning Google Search, YouTube, Android, and other Google applications” that will help to make it a winner in the AI race. At the same time, Alphabet’s core businesses in search and digital advertising remain dominant and possess leading market share – limiting the downside even if AI doesn’t fully pan out for Alphabet.

Of course, in an ideal world, Devitt would like to see Alphabet succeed in AI, and in particular allay concerns that AI queries will replace traditional internet searches by developing a hybrid approach called Search Generative Experience (SGE).

Alphabet is sinking a lot of money into this effort, so Devitt wants to see evidence that Alphabet can control its costs and improve its profit margins as it develops SGE. But generally speaking, Dewitt is optimistic about its prospects. Running 1,200 searches as a test, split 50-50 between traditional searches on Google, and SGE searches, a Wedbush experiment concluded that each method of searching yielded “roughly comparable ads per result page on identical keyword searches despite Google being in the early stages of integrating ads into SGE.” From this, Dewitt concludes that SGE isn’t going to hurt Alphabet’s ad business much at all (and might even help it). In any case, though, the switch to SGE should not unduly threaten “Google Search’s dominance” in the market.

Long story short, Alphabet stock is going to be just fine – and the investors who spent much of this week bidding Alphabet stock higher were right to do so.

Evidently, Devitt’s colleagues also think GOOGL is well-positioned to deliver. The stock has a Strong Buy consensus rating, based on 29 Buy recommendations and 8 Holds. The forecast is for one-year gains of ~10%, given the average price target currently stands at $165.37. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.