SoFi Technologies (SOFI) has received a Buy rating from a Top-rated analyst, Andrew Jeffrey from William Blair, citing the company’s strong market position, financial performance, and strategic expansion. The positive rating came after the personal finance company reported better-than-expected Q1 results.

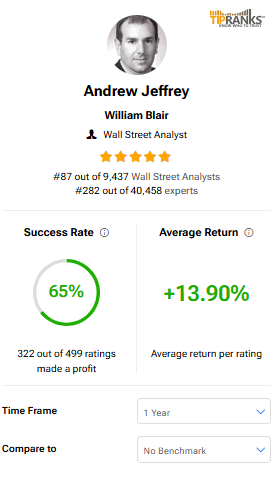

Before moving ahead, it must be noted that Jeffrey ranks 87 out of more than 9,400 analysts tracked by TipRanks. He has a success rate of 65% and has achieved an average return per rating of 13.9% in the past year.

Key Growth Drivers, According to Top Analyst

Jeffrey believes SoFi is in a strong position to grow and compete with traditional banks. The company is expanding its financial services, such as spending, lending, saving, investing, and advisory, which has helped it gain market share and increase monetization, as shown by 48% growth in ARPU (average revenue per user) year-over-year.

Also, SoFi’s business model is shifting toward a more predictable and asset-light approach, making it an attractive investment for future growth.

Further, the five-star analyst is impressed by the company’s growing membership base, up 34% in Q1. Jeffrey noted that SOFI’s earnings quality is also improving, with a bigger share of revenue now coming from tech and financial services, rather than just lending.

A major driver of future growth is SoFi’s loan platform business, which saw robust fee increases in Q1. All these factors combined have convinced Jeffrey that SoFi is well-positioned for long-term success.

Is SOFI Stock a Good Buy?

Turning to Wall Street, SOFI stock has a Hold consensus rating based on four Buys, five Holds, and four Sells assigned in the last three months. At $11.78, the average SOFI stock price target implies a 11.23% downside potential.