A top-rated analyst is pounding the table on Amazon (AMZN) stock ahead of its upcoming financial results, calling shares of the e-commerce company a “must add” to investor portfolios.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Daniel Kurnos, a four-star rated analyst at Benchmark, says a surge in AMZN stock could be imminent, especially if the company reports better-than-expected financial results for this year’s third quarter. In a note to clients, Kurnos called Amazon’s stock a “must add” ahead of the company’s Oct. 30 print.

Kurnos acknowledges that Amazon’s stock has been the worst-performer among the Magnificent Seven mega-cap technology stocks this year. However, he writes that “the tide will turn sooner rather than later” and that the upcoming third-quarter earnings report could be the catalyst needed to give AMZN stock a boost.

Buy Rating

Benchmark maintains a Buy rating on AMZN stock with a $260 price target, which is 19% above current levels. A big factor in the upcoming earnings will be Amazon Web Services (AWS), the company’s cloud-services business. Kurnos writes that AWS will need to show a reacceleration to 20% year-over-year growth to impress Wall Street and send the stock higher.

Kurnos says he’s confident that AWS will jump the high bar that’s been set for it and report growth of 20% or more, beating Wall Street projections of 18.5% growth. Other potential catalysts for AMZN stock include improving operating margins and strong growth in the company’s advertising business.

“We cannot envision a scenario where Amazon is not a winner,” writes the analyst.

Is AMZN Stock a Buy?

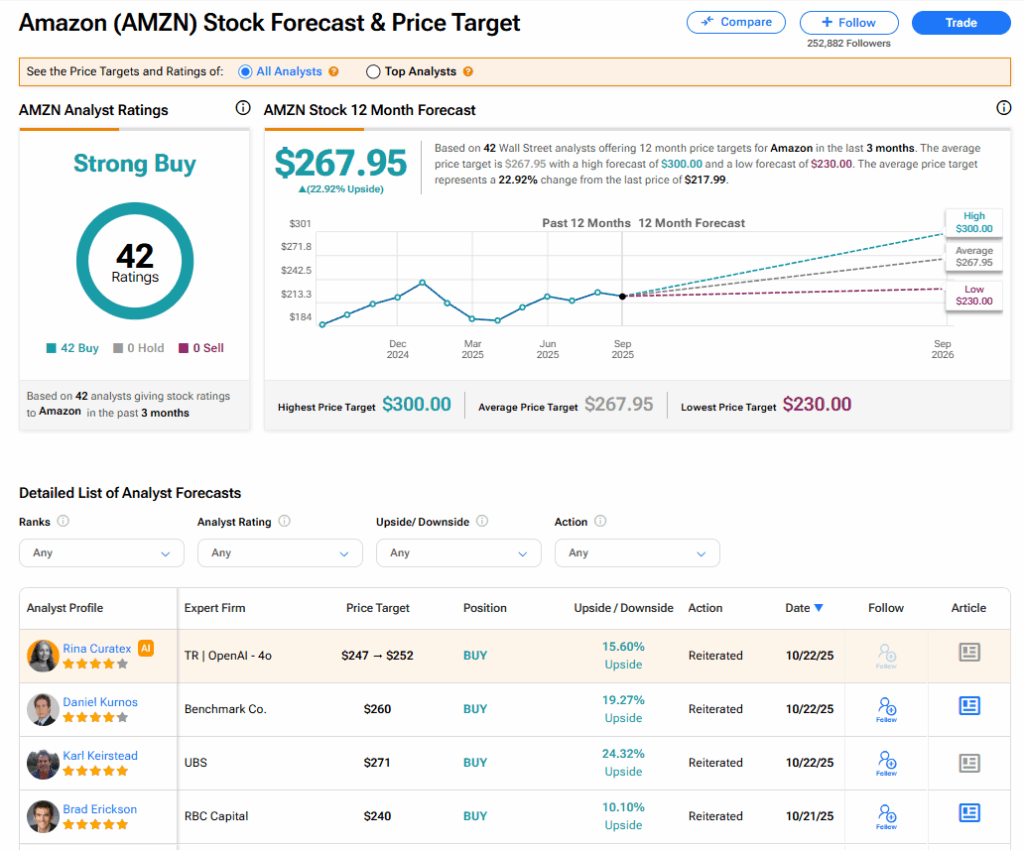

AMZN stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 42 Buy recommendations assigned in the last three months. The average AMZN price target of $267.95 implies 22.92% upside from current levels.