RBC Capital analyst Scott Hanold is optimistic about energy major Devon Energy’s (DVN) recently announced cost optimization strategy. The five-star analyst believes the initiative will strengthen Devon’s ability to generate free cash flow (FCF), boosting value for shareholders. Hanold is pleasantly surprised by the company’s plans, pointing out that the various targets are “both greater in amount and achievable sooner than anticipated.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Devon Energy is slated to report its fiscal first quarter results after the market closes on May 6. The Street expects DVN to post earnings of $1.24 per share, higher than the $1.16 per share reported in Q1FY24. According to TipRanks’ Analyst Forecasts Tool, the consensus for revenue is pegged at $4.43 billion, reflecting an 18.4% year-over-year increase. Currently, Hanold has a “Hold” rating on DVN stock and a price target of $40, implying 27.2% upside potential.

Savings Set to Lift Devon’s FCF Yield Above the Competition

Devon predicts that its business plan will result in $300 million in capital efficiency gains, $250 million in production optimization, $300 million from unlocking commercial opportunities, and about $150 million in corporate cost reductions. Moreover, the company expects approximately 30% of these roughly $1 billion in cost savings to occur by year-end 2025 and the remaining by year-end 2026.

Based on these details, Hanold estimates that the potential cost savings from the initiative could drive a massive 40% improvement to his fiscal 2026 FCF forecast. This would, in turn, push Devon’s FCF yield above 16%, which is “well above it large-cap peers” like Chevron (CVX) and ExxonMobil (XOM).

Oil Price Trends Could Impact Devon’s Outlook

Of course, shifting oil prices could impact on Devon’s outlook. However, Hanold said that given the current oil price environment, Devon is unlikely to make significant changes to its capital spending or production profile. Currently, WTI Crude oil prices are trading around $57.40 per barrel. Additionally, OPEC+ revealed on May 4 that it will increase its oil production by another 411,000 barrels per day in June, which could suppress oil prices further.

Hanold highlighted that Devon currently has a break-even (B/E) price of approximately $45/bbl (WTI), including its dividend. However, with oil prices expected to decline further following the OPEC+ production surge, the company could adjust its capital planning and production strategy accordingly.

Devon to Continue Rewarding Shareholders

On another positive point, the analyst expects Devon to continue rewarding shareholders with $200-$300 million in quarterly stock buyback programs. This will be achieved by maintaining the company’s FCF position. Moreover, Hanold stated that Devon is targeting to reduce net debt by $2.5 billion, while maintaining a leverage ratio of less than 1.0x. For reference, Devon’s short-term debt maturities include $485 million in senior notes due in 2025 and $1 billion in term loans due in 2026. Additionally, DVN stock pays a regular quarterly dividend of $0.239 per share, representing an above-industry-average yield of 3.98%.

Overall, Hanold explained that investors keenly await the earnings report to gain more clarity on several factors, including “synergy savings,” M&A focus, details on core drilling inventory, well performance, increased focus on Anadarko’s gas assets, and the potential for larger stock buybacks.

Who Is Scott Hanold?

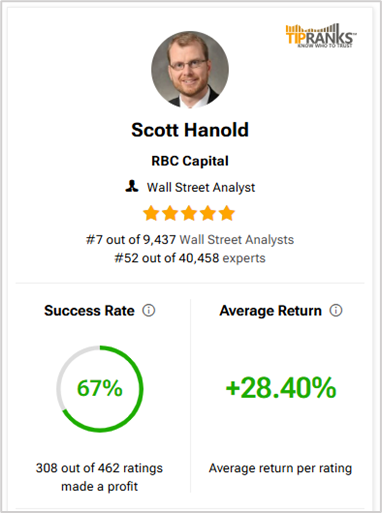

Scott Hanold ranks an incredible #7 out of the 9,437 analysts tracked by TipRanks. Moreover, he boasts a success rate of 67% and an average return of 28.40% per rating. Hanold is a Managing Director at RBC Capital and an industry expert in the U.S. Exploration & Production sector.

Is Devon Energy a Strong Buy?

Overall, Wall Street analysts remain divided on Devon Energy’s stock trajectory amid the macroeconomic uncertainty. On TipRanks, DVN stock has a Moderate Buy consensus rating based on 14 Buys and eight Hold ratings. Also, the average Devon Energy price target of $42.64 implies 35.6% upside potential from current levels. Year-to-date, DVN stock has lost 3.3%.

RBC Disclosures:

A member company of RBC Capital Markets or one of its affiliates received compensation for investment banking services from Devon Energy Corporation in the past 12 months.

A member company of RBC Capital Markets or one of its affiliates expects to receive or intends to seek compensation for investment banking services from Devon Energy Corporation in the next three months.

A member company of RBC Capital Markets or one of its affiliates managed or co-managed a public offering of securities for Devon Energy Corporation in the past 12 months.

A member company of RBC Capital Markets or one of its affiliates received compensation for products or services other than investment banking services from Devon Energy Corporation during the past 12 months. During this time, a member company of RBC Capital Markets or one of its affiliates provided non-securities services to Devon Energy Corporation.

RBC Capital Markets has provided Devon Energy Corporation with non-securities services in the past 12 months.