Microsoft (MSFT) has been riding high on its AI-driven cloud expansion, but is the stock too hot to handle?

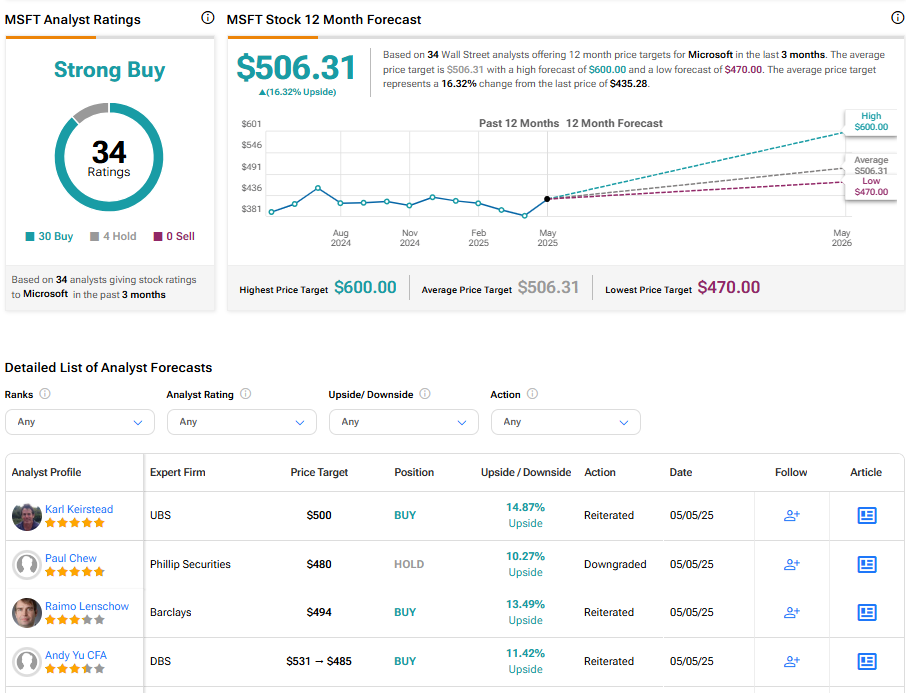

Well, a five-star analyst, Paul Chew from Phillip Securities, thinks so. In a surprising move, she downgraded MSFT stock to Hold from Buy. The lower rating is primarily due to recent gains in Microsoft’s share price, suggesting the stock may have less immediate upside but still holds long-term potential. Importantly, MSFT stock has gained 10% since its fiscal third quarter earnings report, released on April 30.

Despite the downgrade, Wang maintained a $480 price target, which implies 10.27% upside. The Top analyst is confident that demand for large AI models will keep driving Azure’s growth and revenue from Copilot AI tools. Also, she sees MSFT less affected by tariffs, thanks to its strong cloud-based business and broad enterprise customer base.

Analysts Shower MSFT Stock with Buy Ratings

Apart from Chew, four other Top analysts have rated MSFT stock a Buy. Andy Yu, CFA, from DBS assigned a Buy rating on Microsoft, citing its strong market position, AI investments, and Azure growth as key drivers. Despite macro challenges, the analyst believes MSFT’s cybersecurity dominance, cloud expansion, and Activision acquisition support its long-term upside.

It must be noted that the company reported strong performance in Q3, as it beat estimates and issued an upbeat outlook.

Further, the company’s cloud computing platform, Azure, showed continued revenue growth, signaling robust demand for cloud services. Also, Microsoft plans a sequential increase in capital spending, which is likely to support its AI and cloud infrastructure expansion.

Is MSFT Stock a Good Buy?

Turning to Wall Street, MSFT stock has a Strong Buy consensus rating based on 30 Buys and four Holds assigned in the last three months. At $506.31, the average Microsoft stock price target implies a 16.32% upside potential.