All eyes are on semiconductor giant Nvidia’s (NVDA) results for the third quarter of Fiscal 2026, scheduled to be announced on November 19. Heading into Q3 earnings, top Citi analyst Atif Malik raised his price target for NVDA stock to $220 from $210 and reiterated a Buy rating, as he expects the company to report “beat and raise” results. Also, Malik finds Nvidia’s current P/E (price-to-earnings) multiple of 28x appealing compared to the valuations of artificial intelligence (AI) peers Broadcom (AVGO) and Advanced Micro Devices (AMD) at 38x and 37x, respectively.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street expects Nvidia to report a 54.3% year-over-year rise in Q3 FY26 earnings per share (EPS) to $1.25. Revenue is estimated to grow by 56% to $54.62 billion. Despite last week’s pullback in AI and tech stocks amid valuation concerns, NVDA stock is up about 46% year to date, driven by strong demand for the company’s AI GPUs.

Citi Analyst Is Bullish on Nvidia’s Q3 Earnings

Malik expects Nvidia to report Q3 FY26 revenue of $56.8 billion, above the consensus estimate of about $54.6 billion. He expects the company to issue Q4 revenue guidance of $62.6 billion compared to the Street’s expectation of $61.5 billion.

The analyst added that he revised his October-quarter estimates by 11% following Nvidia’s announcement that it has already shipped 6 million units of its Blackwell chips.

Additionally, Malik expects Nvidia to benefit from the continued momentum in B300. He projects NVDA’s data center revenue to grow by 24% and 12% quarter over quarter in Q3 and Q4 FY26, respectively. Also, Malik expects Nvidia to report a 3% and 1% upside to Q3 and Q4 FY26 EPS estimates, respectively, compared to the Street’s expectations.

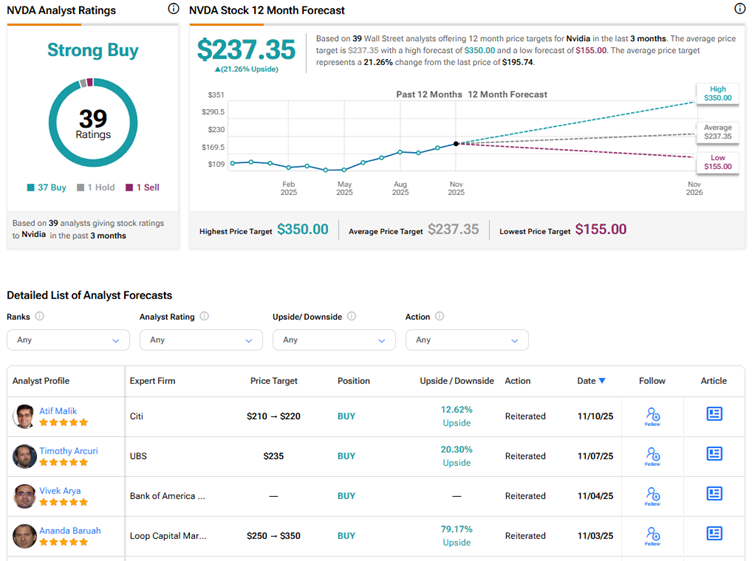

Is NVDA Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Strong Buy consensus rating on Nvidia stock based on 37 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $237.35 indicates 21.3% upside potential.