Top-rated analyst Andrew Jeffrey from William Blair has backed Affirm Holdings’ (AFRM) stock with a Buy rating despite the company’s loss of its partnership with retail giant Walmart (WMT) to Sweden-based rival Klarna. Consequently, AFRM stock fell by over 4% on Monday. However, Jeffrey believes the market reaction to the deal was overstated.

In context, Klarna teamed up with Walmart-backed OnePay to offer installment loans to U.S. shoppers. This deal replaces Affirm as Walmart’s quick credit option, boosting Klarna’s U.S. market reach.

William Blair Keeps Bullish Stance on AFRM Stock

Five-star-rated analyst Jeffrey maintains a Buy rating on Affirm Holdings, arguing that concerns over Klarna’s Walmart deal may be exaggerated. He points out that Walmart isn’t a major revenue driver for Affirm, so the impact is likely minimal.

Following the Klarna-Walmart deal, Affirm clarified that its collaboration with Walmart contributed around 5% of its gross merchandise volume and 2% of its adjusted operating income over the six months ending in December. The company also emphasized that its services remain accessible through direct-to-consumer options, including the Affirm Card.

Additionally, Jeffrey believes Walmart’s switch to Klarna was likely driven by pricing rather than a reflection of Affirm’s performance. Despite losing Walmart as a partner, Affirm’s ability to boost customer loyalty and sales for merchants remains strong. All in all, Jeffrey sees Affirm as an appealing investment, highlighting its strong risk/reward balance and attractive valuation compared to future EBITDA projections.

Is Affirm a Good Stock to Buy Now?

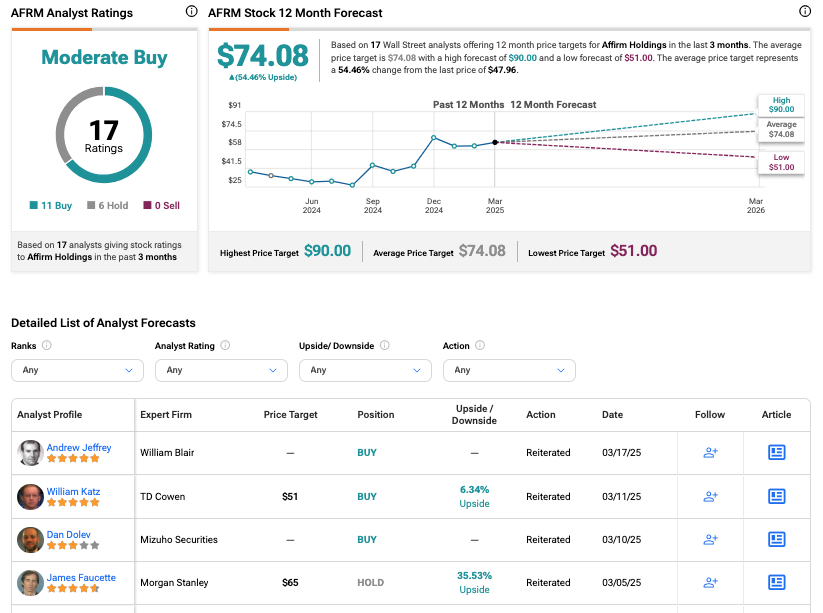

Overall, AFRM stock has received a Moderate Buy consensus rating on TipRanks, based on 11 Buys and six Holds. The average price target for Affirm is $74.08, suggesting an upside of 54.5% from its current price.

Year-to-date, AFRM stock has declined over 20%.

Questions or Comments about the article? Write to editor@tipranks.com