Apple (NASDAQ:AAPL) has frequently ranked among the world’s two most valuable companies, but it has now slipped to third place as the tech giant faces pressure from multiple fronts, all of which are dampening investor sentiment.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The stock has shed 19% this year, dragged down by concerns over antitrust investigations, tariffs, competition in China, and its positioning in AI. The decline makes Apple the weakest performer among the Mag 7 tech giants and puts it well behind the S&P 500, which has gained 1.5% in 2025.

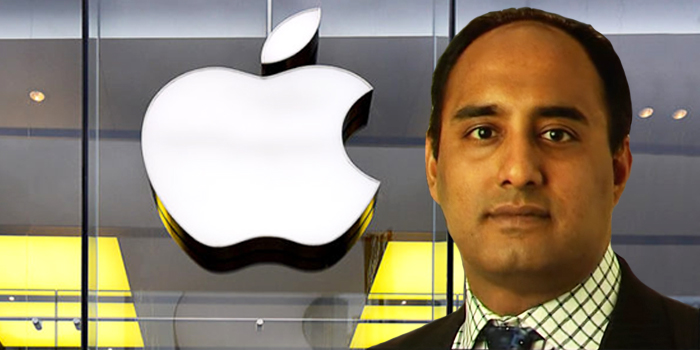

So, with WWDC 2025 (June 9–13) on the horizon, will Apple make a push to close the gap with its big tech peers? Not quite, says Evercore’s Amit Daryanani, an analyst ranked in the top 4% of Wall Street stock experts.

Daryanani thinks that compared to previous years, which featured bigger announcements like Apple Intelligence in 2024 and Vision Pro in 2023, expectations are “rightfully tempered.”

Daryanani reckons the biggest announcement will likely be Apple making its foundation models available to app developers, enabling them to use on-device AI. Additionally, Apple might reveal new partner options beyond OpenAI for its Apple Intelligence platform, which will be built directly into iOS – with Perplexity and Gemini seen as likely candidates. The company is also planning a more extensive update to its operating systems than usual, along with a new naming convention that adds the year at the end, such as iOS 26.

Another key announcement is expected to be a centralized gaming app that will come preinstalled on devices – a strategic move, given that gaming makes up around half of App Store revenue. While there could be a few smaller AI-related updates as well, they likely won’t be significant enough to shift the prevailing view that Apple is still trailing behind in the AI space.

But that take is not quite on the money, says Daryanani. “We continue to think this narrative underestimates Apple’s strategy, which is to focus on smaller scale on-device models and efficient large scale models while sitting out on the AI capex arms race,” the 5-star analyst opined.

Rather than trying to match its peers by pouring tens or even hundreds of billions into AI infrastructure, Apple is sticking with a “more capital light model.” The plan is to let other model providers do the heavy lifting, then charge them – either through revenue sharing or subscription fees – for access to Apple’s iOS user base. Daryanani thinks this strategy gives Apple a way to potentially earn strong returns from AI while avoiding the financial risk of investing billions without a “clear path to monetization.”

“Net/net,” Daryanani summed up, “We think WWDC will be more low key this year with no hardware announcements or major overhauls on par with last year’s Apple Intelligence. Instead we will see some incremental improvements with more meaningful updates expected in 2026.”

All told, Daryanani assigns an Outperform (i.e., Buy) rating to Apple shares, along with a $250 price target that implies a one-year upside of 23%. (To watch Daryanani’s track record, click here)

16 other analysts join Daryanani in the AAPL bull camp and with an additional 9 Holds and 4 Sells, the stock claims a Moderate Buy consensus rating. The average price target stands at $228.79, a figure that factors in 12-month returns of ~13%. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue