Rivian (NASDAQ:RIVN) stock got a bit of a lift on Friday, inching 3% higher in response to an upgrade from Piper Sandler’s Alex Potter, a 5-star analyst rated in the top 5% of the Street’s stock pros.

While acknowledging that RIVN is a risky bet, Potter sees several reasons to back the stock, including:

- Rivian’s R2 is generating great demand in the new car market, with 68,000 R2’s apparently already signed-up-for on pre-order.

- Delaying construction in Georgia will save Rivian more than $2 billion in near-term capital spending, helping to stretch out its existing cash supplies – hopefully, all the way to H1 2026, when the R2 is expected to begin selling.

- Potter himself is a fan of the new EV, calling it “just so cool,” “palatably-priced” at $45,000, and “appeal[ing] to American families.

Potter’s also a fan of the R3 electric hatchback that Rivian unexpectedly announced alongside the R2 last week. Although not much is known about the R3 aside from its general appearance and the fact that it won’t be available for sale until the R2 is out and production is ramping, Potter seems even more excited about the R3 than about the R2, describing it as “a mix between a VW Golf, a Ford Bronco, and a rally car from the 70s,” and arguably “one of the most compelling designs on the market when it is released.”

All of the above – plus the fact that Rivian stock had just plunged 20% over the course of a few days just prior to Potter’s report – explains why the analyst said he felt “compelled to upgrade” Rivian to “overweight” Friday, and to assign Rivian stock a $21 price target indicating it could nearly double over the next 12 months. (To watch Potter’s track record, click here)

But what’s perhaps more interesting in this note are the warnings about Rivian stock that Potter included in it.

Take for example production numbers. Reporting earnings last month, Rivian itself predicted that 2024 production levels will barely budge from 2023 levels, with only 57,000 EVs produced. In making his predictions for the rest of this year, however, Potter posited production of only 53,000 Rivian EVs.

What’s more, looking out further out to 2025 and 2026 production, the analyst further ratcheted back his predictions. While sales will grow in these years, says Potter, his new forecast for 91,000 units in 2025 and 145,000 units in 2026 are both down 30,000 to 40,000 units from what the analyst previously predicted.

Yet, despite these downbeat projections, Potter is now more optimistic about Rivian’s long-term prospects. Whether the company’s strategic decision to forego $2 billion in new capital spending effectively addresses near-term balance sheet concerns remains to be seen.

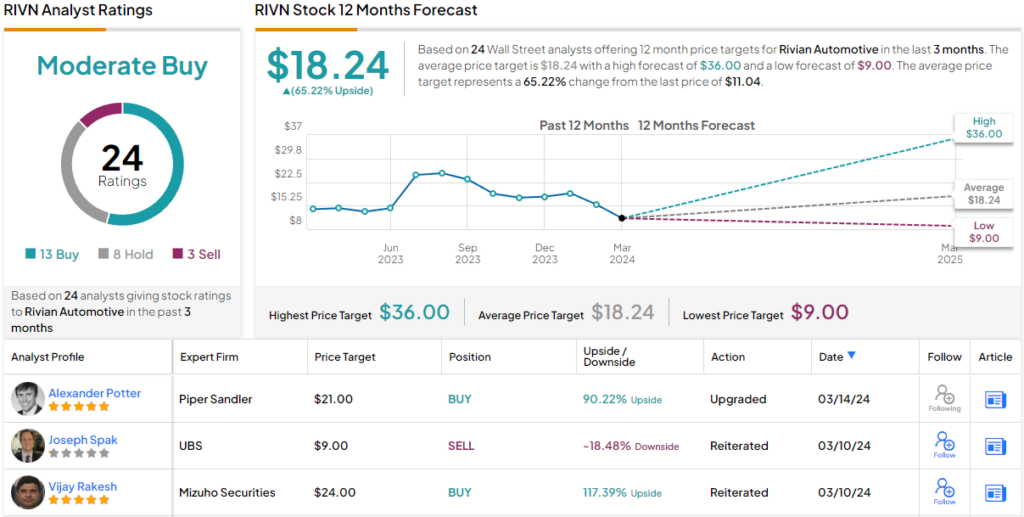

Elsewhere on the Street, RIVN stock claims an additional 12 Buy ratings, 8 Holds, and 3 Sells, for a Moderate Buy consensus rating. Going by the $18.24 average target, a year from now, investors will be sitting on returns of ~65%. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.