Unusual trading volume signals that a stock is moving well above or below its average activity, often driven by major news, upcoming catalysts, or strong institutional interest. Traders look at stocks with unusual volume in anticipation of notable price movements in the days ahead, driven by changes in market sentiment, and to take advantage of attractive buying/selling opportunities.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

TipRanks’ Trending Stocks by Unusual Volume screener provides a snapshot of unusual volumes in U.S. stocks with a market cap of at least $2 billion, a minimum end-of-day price of $1, and a 3-month trading volume of more than 20,000 shares.

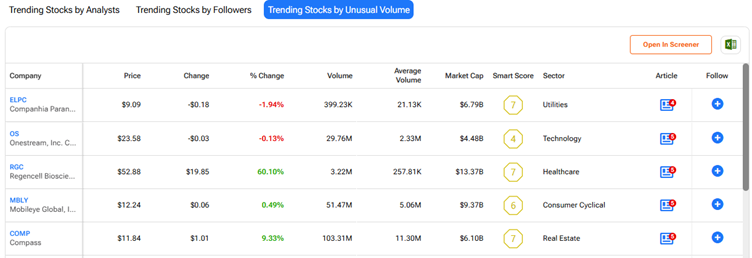

Here are the top five stocks with unusual volumes on January 7, 2026:

- Companhia Paranaense de Energia Sponsored ADR (ELPC) – This Brazilian utility company is engaged in the generation, transformation, distribution, and sale of electricity. On Wednesday, 399.23K ELPC shares were traded, compared to the average volume of 21.13K. The company recently disclosed that asset manager GQG Partners LLC reduced its stake and now holds 70,577,424 ELPC common shares, equivalent to about 2.37% of the total share capital.

- OneStream (OS) – The company offers an artificial intelligence (AI)-powered enterprise finance platform. On Wednesday, 29.76 million shares were traded, way above the average volume of 2.33 million. There has been a surge in the stock’s trading volume following news that private equity firm Hg will acquire OneStream in an all-cash deal valuing the company at about $6.4 billion.

- Regencell Bioscience (RGC) – This early-stage bioscience company focuses on the research, development, and commercialization of traditional Chinese medicine for the treatment of neurocognitive disorders and degeneration, specifically Attention Deficit Hyperactivity Disorder (ADHD) and Autism Spectrum Disorder. On Wednesday, RGC stock jumped 60%. Notably, 3.22 million RGC shares were traded, way above the average volume of 257.81K. There was no specific news on the company. Interestingly, RGC stock has rallied by more than 39,360% over the past year, driven by a 38-for-1 stock split and meme-stock frenzy.

- Mobileye Global (MBLY) – The autonomous driving company is developing self-driving technologies and advanced driver-assistance systems (ADAS), including cameras and computer chips. On Wednesday, 51.47 million MBLY shares were traded, way above the average volume of 5.06 million. The company announced a $900 million deal to acquire Mentee Robotics, a startup developing advanced AI-powered humanoid robots.

- Compass (COMP) – It is a leading tech-powered real estate services company. On Wednesday, 103.31 million shares were traded, compared to the average volume of 11.30 million, with the stock rising 9.3%. The trading volume surged as Compass and Anywhere Real Estate (HOUS) shareholders approved the merger between the two companies. The merger is expected to close on January 9, 2026.