Unusual trading volume signals that a stock is moving well above or below its average activity, often driven by major news, upcoming catalysts, or strong institutional interest. Traders look at stocks with unusual volume in anticipation of notable price movements in the days ahead, driven by changes in market sentiment, and to take advantage of attractive buying/selling opportunities.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

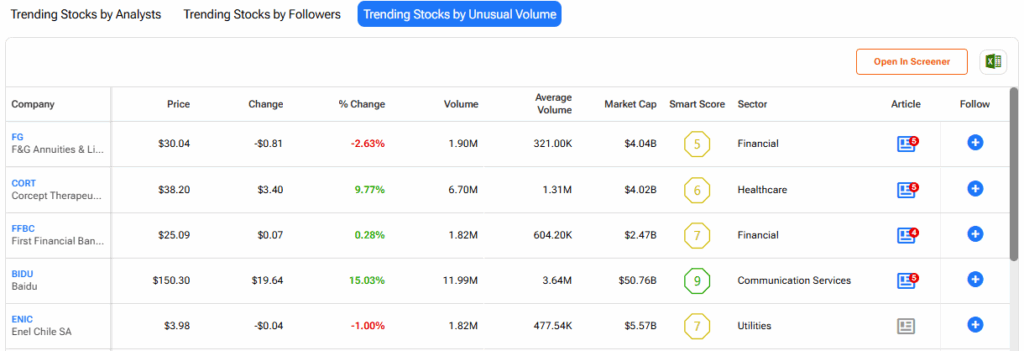

TipRanks’ Trending Stocks by Unusual Volume screener provides a snapshot of unusual volumes in U.S. stocks with a market cap of at least $2 billion, a minimum end-of-day price of $1, and a 3-month trading volume of more than 20,000 shares.

Here are the top five stocks with unusual volumes on January 2, 2026:

- F&G Annuities & Life Inc. (FG) – F&G offers insurance solutions to retail annuity and life customers as well as institutional clients. On Friday, FG stock fell 2.63%, with a volume of 1.90 million, compared to the average volume of 321K. There has been a surge in the trading volume for FG stock due to the special stock distribution of about 16.3 million FG shares to parent company Fidelity National Financial’s (FNF) shareholders. On December 31, FNF shareholders received six FG shares for every 100 shares held.

- Corcept Therapeutics (CORT) – The company is focused on developing medications to treat severe endocrinologic, oncologic, metabolic, and neurologic disorders by modulating the effects of the hormone cortisol. On Friday, 6.7 million CORT shares were traded, compared to the average volume of 1.31 million. CORT stock soared about 10% on Friday, recovering from its 50% decline on Wednesday after Corcept announced that it received a complete response letter from the Food and Drug Administration regarding its new drug application for relacorilant as a treatment for patients with hypertension secondary to hypercortisolism, citing the need for additional effectiveness data.

- First Financial Bancorp (FFBC) – It is a bank holding company that offers banking and financial services through its subsidiary, First Financial Bank. On Friday, 1.82 million FFBC shares were traded, compared to the average volume of 604.20K. The rise in volumes followed the completion of the company’s previously announced acquisition of Chicago-based BankFinancial Corporation through an all-stock transaction on January 1, 2026.

- Baidu (BIDU) – Shares of Chinese tech giant Baidu jumped 15% on Friday, as the company announced plans to spin off and list its artificial intelligence (AI) chip unit, Kunlunxin, on the Hong Kong Stock Exchange. Consequently, there was a spike in the volume of BIDU shares traded on Friday to 11.99 million, compared to the average of 3.64 million.

- Enel Chile SA (ENIC) – It is a Chilean energy company involved in power generation, distribution, and renewable energy. On Friday, 1.82 million ENIC shares were traded, compared to the average volume of 477.54K. There was no major news on the stock.