Nvidia (NASDAQ:NVDA) stock hasn’t exactly had a joyride this year. After an unstoppable bull run through most of 2023 and 2024, the shares hit a speed bump, sliding 13% in the early months of 2025.

A perfect storm of geopolitical tensions, DeepSeek revelations, rising tariffs, and looming recession fears has cast a shadow over investor sentiment, dragging the stock lower.

Yet, despite the market’s pessimism, Nvidia continues to defy expectations with eye-popping results. The company’s latest earnings report in late February shattered records yet again, boasting a $130.5 billion in revenue for FY 2025 – a 114% surge from the previous year.

While the market wavers, one top investor isn’t blinking. Known by the pseudonym On the Pulse, this seasoned pro believes there are plenty more gains to come.

“NVDA’s dominant 92% market share in data center GPUs and substantial profit growth make it a compelling long-term investment at an attractive valuation,” asserts the 5-star investor, who is among the top 4% of TipRanks’ stock pros.

The Blackwell ramp is an especially compelling source of optimism. On the Pulse points out that these cutting-edge GPUs have already generated billions in sales – and this could be just the tip of the iceberg.

The investor cites a Bloomberg Intelligence report which estimates that the current use of generative AI is only 10% of the supposed market in 2032.

“The expansion of the generative AI market is therefore the single biggest catalyst for NVIDIA and, according to Bloomberg Intelligence, points to a big up-scaling of AI chip deliveries in the future,” the investor adds.

Of course, geopolitical risks – particularly U.S. export restrictions to China – remain a wildcard for the stock. But On the Pulse believes the generative AI boom far outweighs these concerns.

In fact, the investor contends that the stock’s recent dip has only made NVDA shares even more attractive.

“Investors buying the market meltdown triggered by completely unrelated (short-term) trade concerns, have an opportunity to buy NVIDIA’s stock at a substantial discount to the chip company’s valuation just three months ago,” On the Pulse summed up.

Not surprisingly, the investor is rating Nvidia shares as a Buy. (To watch On the Pulse’s track record, click here)

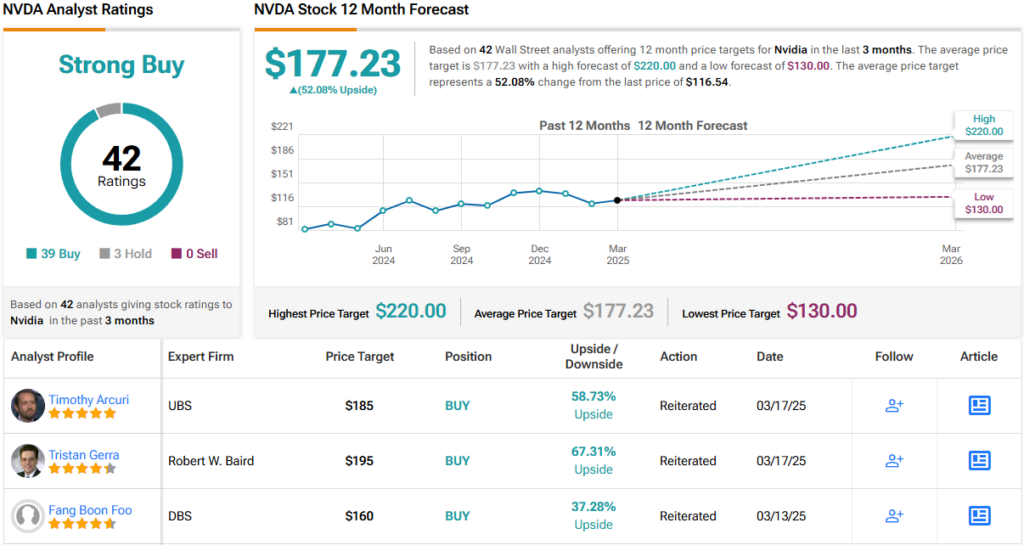

Wall Street requires no additional convincing. With 39 Buy and 3 Hold recommendations, Nvidia boasts a Strong Buy consensus rating. Its 12-month average price target of $177.23 implies 52% gains in the year ahead. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.