Bitmine Immersion Technologies (BMNR), the serial cryptocurrency acquirer, has increased its holdings of Ethereum (ETH) to 4.14 million tokens worth $13.3 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bitmine, which is run by analyst-turned-crypto-guru Tom Lee, now owns 3.43% of the total Ethereum supply. Bitmine Immersion Technologies has a stated goal to own 5% of the available Ethereum supply. The company’s crypto and cash holdings now total $14.2 billion, including $915 million in cash.

Lee, who is Bitmine’s Chairman, said the company added nearly 33,000 ETH to its treasury in the last week. Lee has predicted that the price of Ethereum will reach $250,000 if the price of Bitcoin (BTC) eventually hits $1 million.

Bitmine’s Staked Ethereum

As of Jan. 4, Bitmine had staked 659,219 Ethereum, or about $2.1 billion worth of its holdings. The firm, which currently collaborates with three staking providers, aims to expand this number through the launch of its own in-house validator, which is scheduled to go live later this year.

If fully staked at current rates, Bitmine would receive more than $1 million a day in staking rewards. Crypto staking is the practice of locking up digital tokens in a blockchain network to help validate transactions and secure the network in exchange for earning rewards in the form of more crypto. Analysts say it is similar to earning interest in a bank account.

Is ETH a Buy?

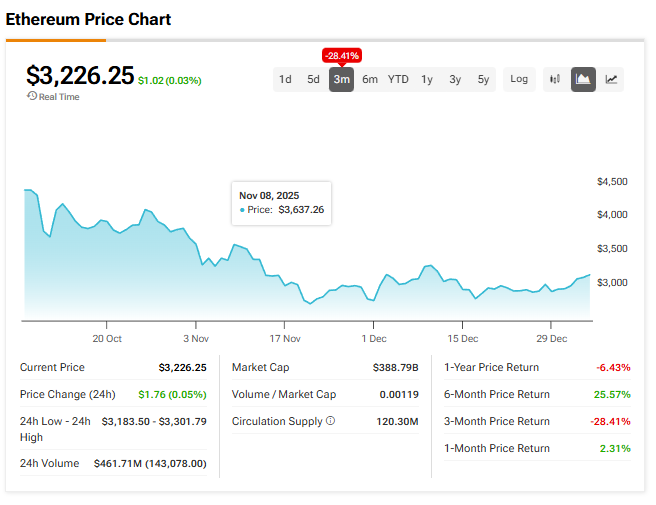

Most analysts don’t offer ratings or price targets on Ethereum. So instead, we’ll look at the three-month performance of ETH. As one can see in the chart below, the price of Ethereum has fallen 28.41% over the last 12 weeks.