Tobacco stocks including British American Tobacco (BTI) and Philip Morris (PM) were smoking today as investors concerns over “Liberation Day” dragged down markets.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Investors Seek Comfort

British American Tobacco stock was 1% higher in pre-market trading. It was also helped by its announcement today that it is executing a share buyback program. Philip Morris stock was up 0.5% in pre-market trading.

This was in stark contrast to global markets which were left in negative territory including the FTSE 100 and the Nikkei 225.

Investors flocked to these and other defensive stocks such as utilities as stock markets around the world steeled themselves for the so-called U.S. “Liberation Day” on April 2. This is when President Donald Trump’s long-threatened tariffs on a range of products from metals to cars come into force hitting trade with countries such as Canada, Mexico, the EU and China.

Trump Brings a Bad Day

“Donald Trump continues to be the key reason why markets are having a bad day. He has now threatened to target all countries importing goods into the US with tariffs, further clouding economic prospects around the world. Investors raced for protection by buying gold and defensive stocks including tobacco manufacturers and utilities,” said Russ Mould, investment director at AJ Bell.

The likelihood is that stocks such as those in the tobacco sector will keep rising. Despite the industry being battered in recent years given the link between smoking and serious diseases such as cancer, it is still seen as a safe haven for investors during troubled times. Tobacco stocks, as seen today by British American Tobacco, are also traditionally seen as solid dividend payers for income investors.

The smoking habit is also largely unaffected by fluctuations in the economy as people see their cigarettes and cigars as an everyday spend rather than a luxury.

Is PM a Good Stock to Buy Now?

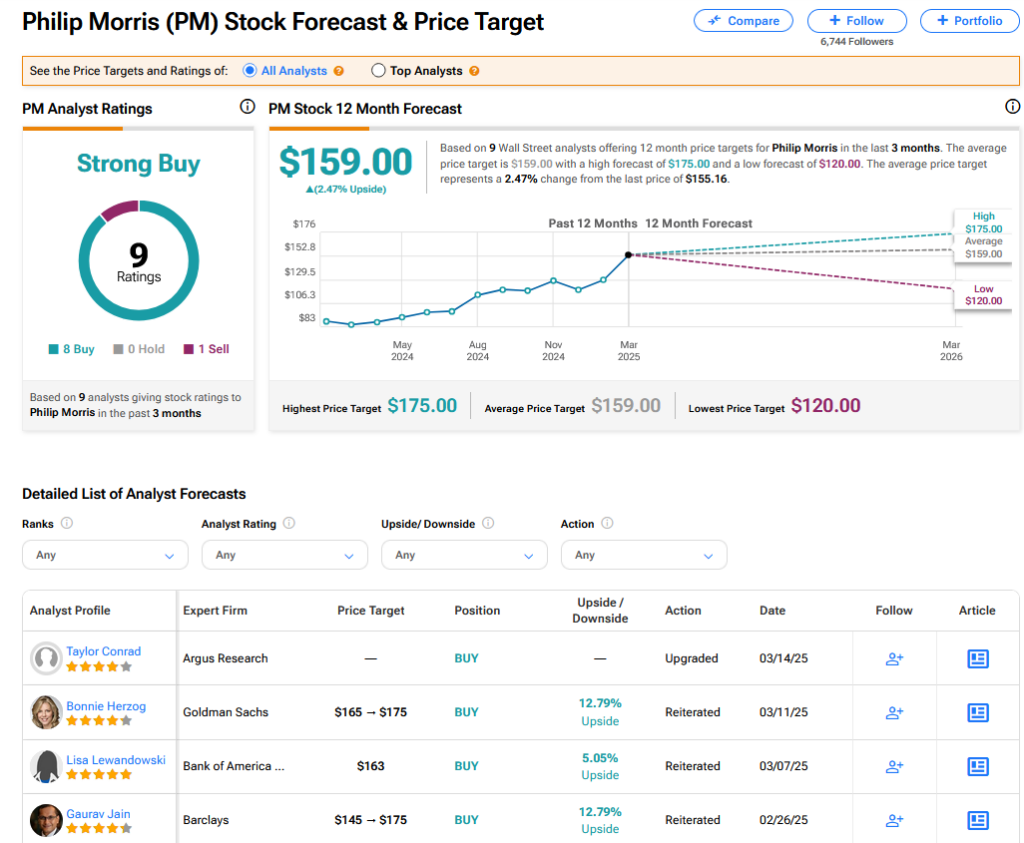

On TipRanks, PM has a Strong Buy consensus based on 8 Buy and 1 Sell rating. Its highest price target is $175. PM stock’s consensus price target is $159 implying an 2.47% upside.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue