Japanese automotive major Toyota (NYSE:TM) reported a nearly 80% jump in its Q4 top line as the company benefitted from robust demand for hybrids and a weak Yen (FX:USD-JPY). However, it expects a drop in profits for the full year owing to higher costs.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

TM’s Bumper Results

For the full year, Toyota’s top line rose by 21.4% to ¥45 trillion, and net income jumped by around 102% to ¥4.94 trillion. In Q4, the company’s top line rose by around 14% to ¥11.1 trillion and net income jumped by 80% to ¥997.6 billion.

This performance was driven by a nearly 7% jump in vehicle shipments for the year as well as the company’s cost reduction efforts. Importantly, Toyota clocked nearly 30% higher sales in North America and 32.9% higher sales in Europe despite tough macroeconomic conditions and challenging times for the automotive industry globally.

Toyota’s Outlook Disappoints

For Fiscal year 2025, Toyota expects a 2% increase in its top line. However, it anticipates that there will be a nearly 27.8% contraction in its bottom line, which points to cost challenges for the company. Importantly, Toyota plans to repurchase shares worth ¥1 trillion by the end of FY2025.

Is TM Stock a Buy, Sell, or a Hold?

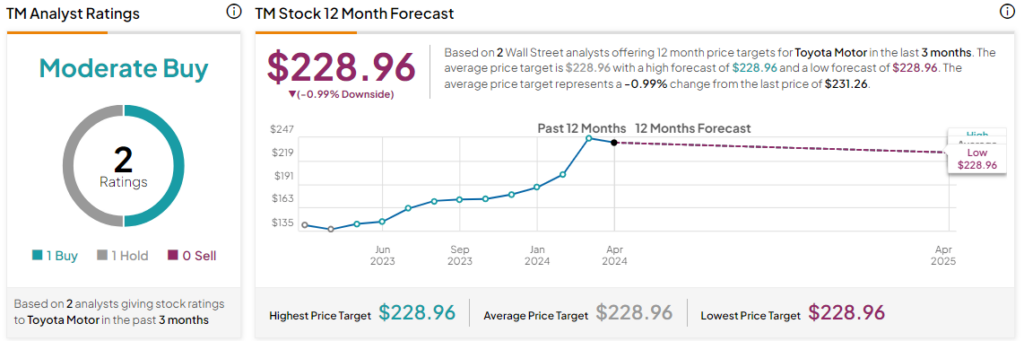

Toyota’s share price has rallied by nearly 68% over the past year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average TM price target of $228.96. However, analysts’ views on the company could see a revision following today’s earnings report.

Read full Disclosure