Shares of Tilray (TLRY) gained in after-hours trading after the cannabis company reported earnings for its fourth quarter of Fiscal Year 2024. Earnings per share came in at $0.04, which beat analysts’ consensus estimate of -$0.02 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased by 24.8% year-over-year, with revenue hitting $229.88 million. This jump in revenue was mainly driven by a 137% surge in Beverage-alcohol sales from $32.3 million to $76.7 million, which were due to product innovations and the acquisitions of several beer brands from Anheuser-Busch (BUD).

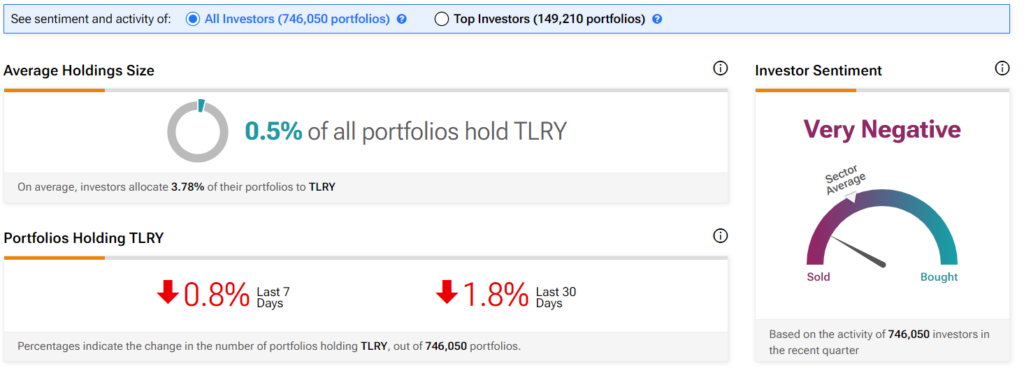

Investor Sentiment for TLRY Stock

The sentiment among TipRanks investors is currently very negative. Out of the 746,050 portfolios tracked by TipRanks, 0.5% hold TLRY stock. In addition, the average portfolio weighting allocated towards TLRY among those who do have a position is 3.78%. This suggests that investors of the company are fairly confident about its future.

However, in the last 30 days, 1.8% of those holding the stock decreased their positions. As a result, the stock’s sentiment is below the sector average, as demonstrated in the following image:

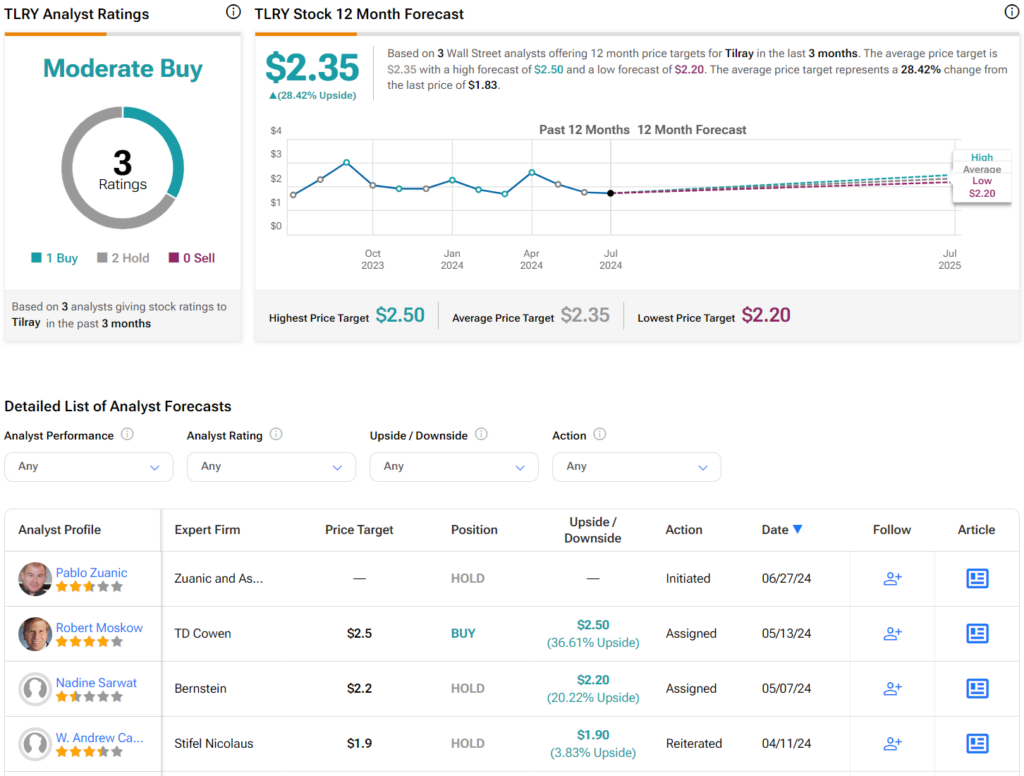

Is TLRY Stock a Good Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TLRY stock based on one Buy and two Holds assigned in the past three months, as indicated by the graphic below. After a 28% decline in its share price over the past year, the average TLRY price target of $2.35 per share implies 28.42% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.