Tilray Brands (NASDAQ:TLRY) (TSX:TLRY) plunged in pre-market trading after the company issued weak guidance. In FY24, the cannabis company is guiding to adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) in the range of $60 million to $63 million. This is below the company’s prior forecast of adjusted EBITDA, which was between $68 million and $78 million.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In addition, Tilray does not expect to generate positive adjusted free cash flow for FY24, due to a delay in cash collection on sales of various assets. In the Fiscal third quarter, the company posted revenues of $188.3 million, up by 30% year-over-year but fell short of consensus estimates of $199.4 million.

Tilray’s Q3 net loss narrowed to $0.12 per share as compared to a loss of $1.90 per share in the same period last year. Analysts were expecting TLRY to report a loss of $0.05 per share.

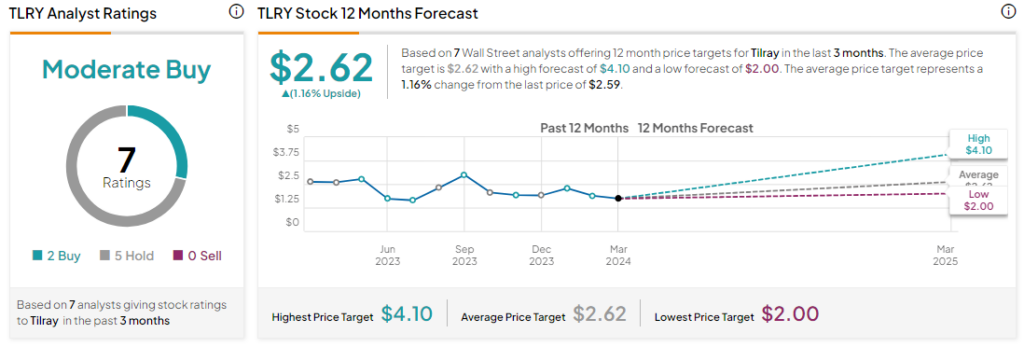

What Is the Price Target for TLRY?

Analysts remain cautiously optimistic about TLRY stock, with a Moderate Buy consensus rating based on two Buys and five Holds. Year-to-date, TLRY has increased by more than 10%, and the average TLRY price target of $2.62 implies an upside potential of 1.2% at current levels. These ratings are likely to change as TLRY announced its Fiscal Q3 results today.