For entertainment stock TKO Group (TKO), its recent pushes into worldwide expansion have been going reasonably well. In fact, reports note that its move to help bring boxing to Saudi Arabia has proven to be a deal unlike anything the General Entertainment Authority has seen so far. This advance is proving to be good news for TKO as well, and investors sent shares up nearly 3% in Thursday afternoon’s trading.

Much of the deal is the brainchild of Turki Alalshikh, the current chair of the General Entertainment Authority who, as it happens, is also a huge boxing fan. Alalshikh turned to TKO Group and another company, Sela, to set up a multi-year arrangement to bring boxing to the country. In the process, investors hope, the deal will help unify a sport that has often been considered “fragmented,” particularly when compared with other sports.

In fact, according to Shirin Malkani of Perkins Coie’s sports industry group, the current fragmented condition of boxing was part of what made such a great opportunity for TKO to get in. Malkani noted “It’s the right kind of dysfunction, which creates an opportunity. The media rights alone are ripe for thoughtful consolidation.”

A Growing Interest

Meanwhile, TKO is also landing some gains elsewhere. For instance, Kansas City recently saw the first-ever “TKO Takeover” event, which brought together three different sports—PBR, UFC, and WWE action—all together at Kansas City’s T-Mobile Center. Basically, that’s bull riding, ultimate fighting, and wrestling all in one package, the kind of package that will certainly bring interested patrons—and paying customers—in.

TKO also came off a huge win at Las Vegas, particularly the Allegiant Stadium. There, TKO found that Wrestlemania 41 was the single highest-grossing event that the WWE had ever seen. Attendance hit 14,693, reports noted, and represented—brace yourself for this one—a 114% increased over the previous record, which was set just last year. Expecting that kind of growth to continue may be a long shot, but when a sport is setting and breaking its own records, that suggests a lot of interest, and a lot of paying customers.

Is TKO Stock a Good Buy?

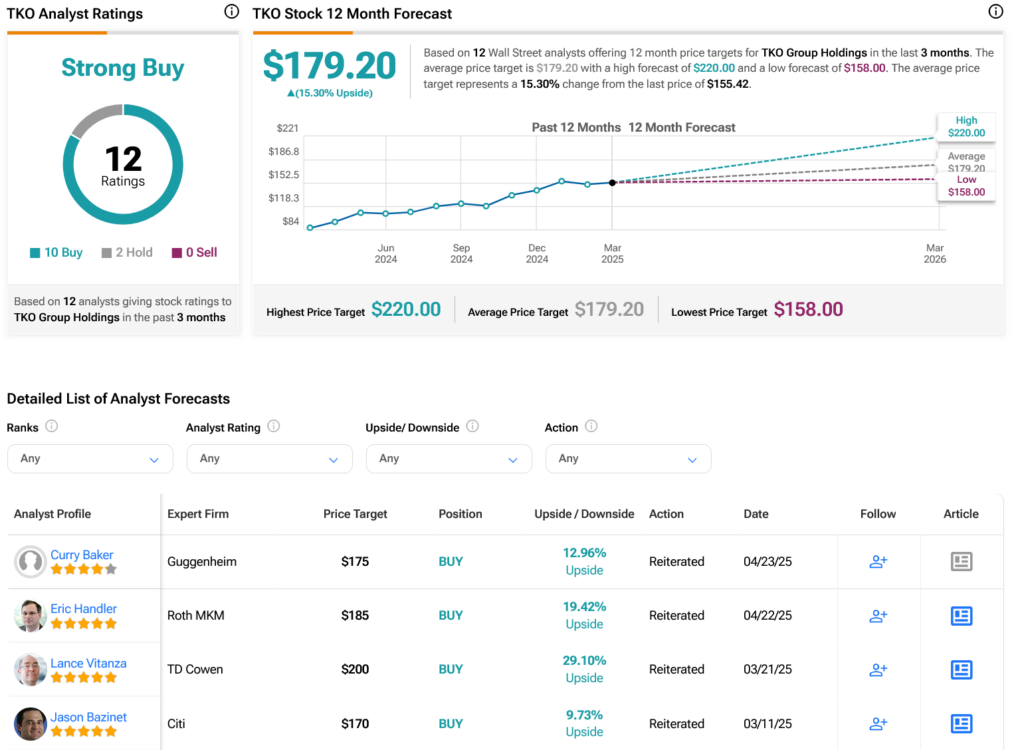

Turning to Wall Street, analysts have a Strong Buy consensus rating on TKO stock based on 10 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 61.48% rally in its share price over the past year, the average TKO price target of $179.20 per share implies 15.3% upside potential.