The TJX Companies (NYSE:TJX) reported strong Q1 earnings of $0.93 per diluted share, up by 22% year-over-year, exceeding analysts’ consensus estimate of $0.88 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The off-price department store retailer’s sales increased by 6% year-over-year, with revenue hitting $12.5 billion, compared to analysts’ expectations of $12.48 billion. The retailer’s comparable store sales increased by 3% in the first quarter.

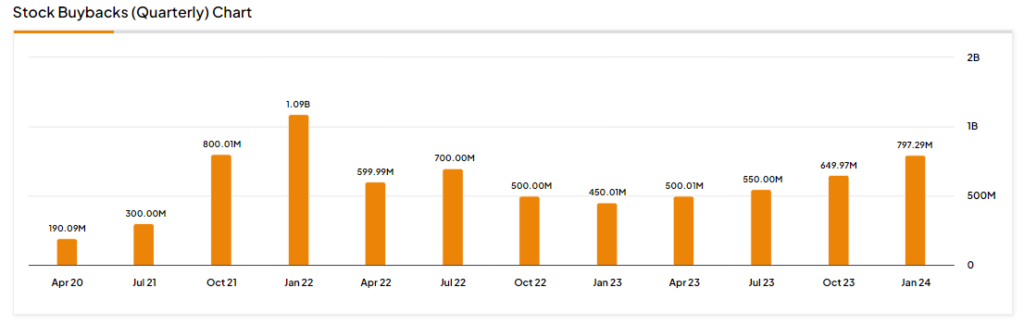

TJX’s Stock Buyback

During the first quarter of FY25, the company repurchased shares worth $509 million and paid $377 million in shareholder dividends. During the fourth quarter of FY24, TJX had repurchased stock worth $797.3 million.

The retailer stated that during FY25, the company expects to buy back TJX stock worth $2 billion to $2.5 billion but may adjust this amount “depending on various factors.”

TJX’s Q2 and FY25 Outlook

Looking forward, management now expects its comparable sales to be up 2% to 3% in the second quarter, with diluted earnings likely to be in the range of $0.88 to $0.90 per share but below the analyst consensus of $0.94 per share.

In FY25, TJX has projected comparable store sales to increase by 2% to 3% and raised its diluted earnings outlook to be in the range of $4.03 to $4.09 per share. This is above the Street estimate of $4.10 per share.

Is TJX a Good Stock to Buy?

Analysts remain bullish about TJX stock, with a Strong Buy consensus rating based on 17 Buys and one Hold. Over the past year, TJX has surged by more than 20%, and the average TJX price target of $113.82 implies an upside potential of 16.5% from current levels. These analyst ratings are likely to change following TJX’s Q1 results today.