Shares of The TJX Companies (NYSE:TJX) are on the rise today after the off-price apparel and home fashions retailer delivered robust fourth-quarter results. With a year-over-year jump of 13%, revenue of $16.41 billion outpaced expectations by $210 million. EPS of $1.12 came in line with expectations. This was a 26% year-over-year jump in the company’s bottom line.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, consolidated comparable store sales rose by 5% due to an increase in customer transactions. Importantly, TJX clocked comparable store sales growth across its Marmaxx, HomeGoods, TJX Canada, and TJX International divisions. Further, net sales rose by double digits across all of its verticals.

A combination of higher merchandise margin and expense leverage helped TJX improve its pretax profit margin by 200 basis points to 11.2% in Q4. Additionally, operating cash flow for the full year remained at a healthy $6.1 billion. Buoyed by this performance, TJX plans to increase its quarterly dividend (to be declared in April and payable in June) by 13% to $0.375 per share.

Moreover, TJX plans to repurchase shares worth $2 billion to $2.5 billion in Fiscal Year 2025. For the upcoming quarter, TJX expects comparable store sales growth in the 2% to 3% range. EPS for the quarter is seen landing between $0.84 and $0.86. For the full year, the retailer pegs comparable store sales growth between 2% and 3% and EPS between $3.94 and $4.02.

Is TJX a Good Stock to Buy?

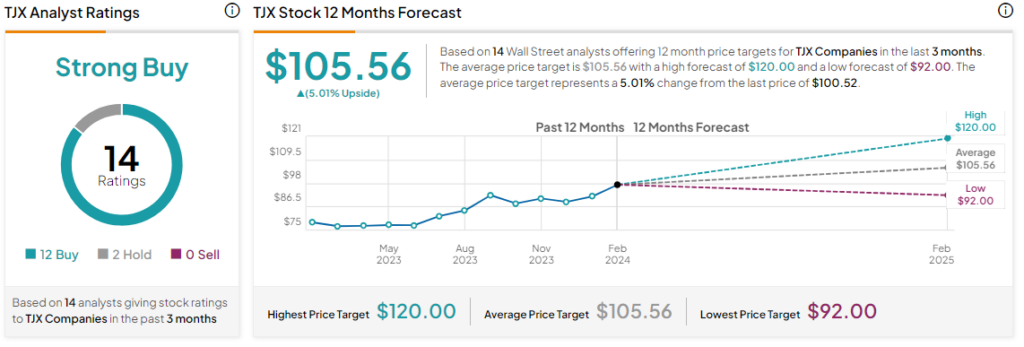

Overall, the Street has a Strong Buy consensus rating on TJX Companies alongside an average price target of $105.56. However, analysts’ views on the stock could see a revision following today’s earnings report. Shares of the company have steadily climbed by about 33% over the past year.

Read full Disclosure