In days when most of the pure-play quantum computing companies make headlines, Arqit Quantum (ARQQ), a company operating in the quantum encryption space, is relatively quiet in comparison to its counterparts. Quantum is one of the hottest fields within the quantum industry; however, ‘Spark,’ TipRanks’ AI analysts are holding back on a bullish call for now, rating the stock as Neutral with a relatively low score of 45, and a price target of $41.00. This is despite the stock boasting a Smart Score of 8.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Good News First

Arqit’s tech is gaining traction. Its core product, QuantumCloud, delivers quantum-secure encryption keys via a SaaS platform. Recent contract wins, including a key deal with the U.S. Department of Defense and a tier-one telecom provider, validate its tech and build credibility in the defense and telecom sectors.

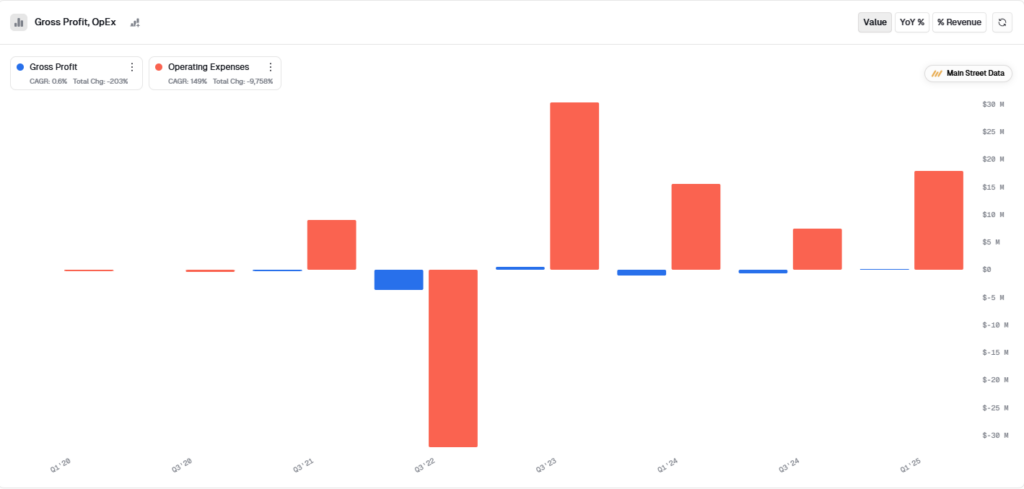

The company is also executing a strategic shift. Arqit is transitioning away from one-off enterprise sales to a recurring revenue model. This SaaS pivot supports scalability and aligns with long-term growth trends. Meanwhile, operating costs are growing at a slower pace than revenues, signaling strong operating leverage. A leaner workforce – down from 125 to 82 – reflects tighter cost control.

Add in investor enthusiasm for quantum computing, a sector riding the wave of AI-style optimism, and there’s definitely long-term growth potential here.

But the Red Flags Are Hard to Miss

Despite these positives, Arqit’s financials remain under pressure. Revenue for the first half of 2025 dropped to $67,000, down from $119,000 in the same period last year. Operating losses widened to $17.8 million, and delayed revenue recognition has further dragged results. With $24.8 million in cash, the company has only six to nine months of runway unless it generates meaningful revenue or raises more capital.

Technical indicators are mixed. While the stock has surged over 400% in the last year and is trading well above its moving averages, momentum indicators like MACD, RSI, and Stochastic suggest the stock might be overbought.

Fundamentally, Arqit’s valuation remains difficult to justify, according to Spark, with a shrinking equity base, negative free cash flow, and persistent net losses, its financial health is a concern. While its collaborations, like the integration with Intel’s TDX, open doors, execution risk remains high.

The Bottom Line

ARQQ is showing progress, but the road ahead is still bumpy. TipRanks’ AI analyst is sitting on the sidelines for now. Until Arqit can convert contracts into consistent revenue and stabilize its financials, Hold is the call.