While consumer spending is considered the big driver of the US economy, we can’t ignore the housing sector. A home is usually an individual’s single largest financial asset – making the high interest rates of the last few years, and consequent high mortgage rates, a point of real concern.

But the Federal Reserve has recently enacted its first rate cut since March of 2020, and analysts are expecting another cut later this year. So far, the new policy has not yet filtered into the mortgage market – rates on home loans are still well above 6% – but industry groups in the homebuilding sector are noting increased confidence among homebuilder companies.

The builder companies are confident that mortgages will start coming down – and that will lead to increased demand as homes become more affordable. And this has top analyst Jay McCanless, from Wedbush, upbeat on the prospects for homebuilding stocks.

The Wedbush expert, who is rated by TipRanks among the top 2% of Wall Street’s analysts, has upgraded two homebuilder stocks, showing investors that it’s time to turn bullish on them. We’ve used the TipRanks database to pull up the details on these Wedbush picks; here they are, along with the analyst’s comments.

Taylor Morrison (TMHC)

The first homebuilder that we’ll look at is Taylor Morrison, one of the largest home construction companies in the US, operating across 12 states. These include high-growth markets like Florida, Texas, and Arizona, as well as regions on the West Coast, Nevada, Georgia, the Carolinas, Indiana, and Colorado. In addition to its core construction services, the company provides a comprehensive suite of customer services, such as a design studio, online home tours and purchasing options, home financing, and warranty services.

While the homebuilding industry as a whole has faced headwinds recently, Taylor Morrison has seen solid performance this year. The company’s top and bottom lines have been stable or trending upwards in recent months, and the stock has gained 31% year-to-date, outperforming the broader market.

Looking at Taylor Morrison’s most recent quarterly report, covering 3Q24, we find that the company generated total revenues of $2.12 billion, up more than 26% year-over-year and $150 million better than had been forecast. The company brought in $2.37 in EPS, beating expectations by 33 cents per share.

These results were supported by a solid gain in net sales orders for the quarter, which were up 9% to 2,830, and by the quarterly total of 3,394 home closings. These had an average price of $598,000, and generated approximately $2 billion in home closings revenues. The gross margin on home closings was up y/y, from 23.1% to 24.8%.

Wedbush analyst Jay McCanless views the company’s consistent performance as a cornerstone of its success, anticipating that the company will continue creating value for its shareholders.

“We think the better than expected gross margin in F3Q24 and TM’s long term gross margin outlook (circa 24%, in line w/recent results) are catalysts to raise our EPS estimates and PT. We also see TM’s multiple buyer segments, especially lifestyle and move up buyers, as catalysts to achieve our FY25 volume and revenue targets. Lastly, we believe TM’s consistent share repurchase in FY24 and the new $1 billion buyback announced in the F3Q24 release are also catalysts for a more positive view on the shares,” McCanless opined.

McCanless, as noted, has upgraded his stance from Neutral to Outperform (i.e. Buy), and sets an $85 price target that points toward a one-year upside potential of ~24%. (To watch McCanless’ stock forecast, click here)

All in all, Taylor Morrison Stock has a Strong Buy consensus rating on the Street, based on 6 reviews that include 5 Buys and 1 Hold. The shares are trading for $68.72 and their average target price of $84.67 indicates room for an upside of nearly 23% by this time next year. (See TMHC stock forecast)

Toll Brothers (TOL)

The second homebuilder stock we’ll look at is Toll Brothers. This $15 billion, large-cap building company handles all aspects of homebuilding: design, construction, marketing, and financing; it operates in both the residential and commercial real estate sectors. The company uses luxury to differentiate itself from its competition, giving its customers choices of distinctive architecture along with high-end appliances, fixtures, and fittings in the completed structure.

Toll Brothers has a large footprint, with operations in more than 60 real estate markets across 24 states. The company’s largest areas of operation are in the Northeast, Southeast, and Southern California, with additional activities in the Pacific Northwest and the state of Texas. All of these regions have reputations for solid growth, desirable real estate, or both.

In the past year, Toll Brothers’ stock has seen its ups and downs – a pattern of volatility overlaid on a generally upward trajectory. Overall, the stock has gained more than 47% in 2024. Additionally, in the company’s results for fiscal period 3Q24, which ended on July 31, both revenues and earnings beat the forecasts.

The top line hit $2.73 billion, $20 million ahead of the estimates and up 1.5% year-over-year. The bottom line, of $3.60 per share in non-GAAP measures, was 27 cents per share better than expectations. In the fiscal third quarter, Toll Brothers saw 11% y/y gains in both the net signed contract value ($2.41 billion) and the contracted homes (a total of 2,490). Both metrics bode well for future work, as does the $7.07 billion backlog on the books.

Checking in again with McCanless and Wedbush’s view, we find that the analyst is staking his position here on the company’s luxury niche – and its customer base that is more readily capable of moving back into a purchasing mood.

“We believe the recent pullback in the shares due to rising mortgage rates has created a buying opportunity. We believe the average Toll buyer is less concerned with their monthly payment versus the bulk of our stick builder coverage. Instead, we believe the average Toll buyer is more attuned to their personal financial situation, and with the stock market reaching all time highs in recent days, we think that could be a tailwind for demand. We would also point to recent positive demand commentary from TOL’s public move up competitors. While the move up buyer is not completely rate insensitive, we believe the lack of existing homes in most markets are pushing must move buyers (births, marriage, etc.) into new homes which should benefit TOL & the move up builders,” McCanless commented.

Once again, this is a stock that the analyst has upgraded, from Neutral to Outperform or Buy. McCanless’ $175 price target suggests a ~20% potential share gain on the one-year horizon.

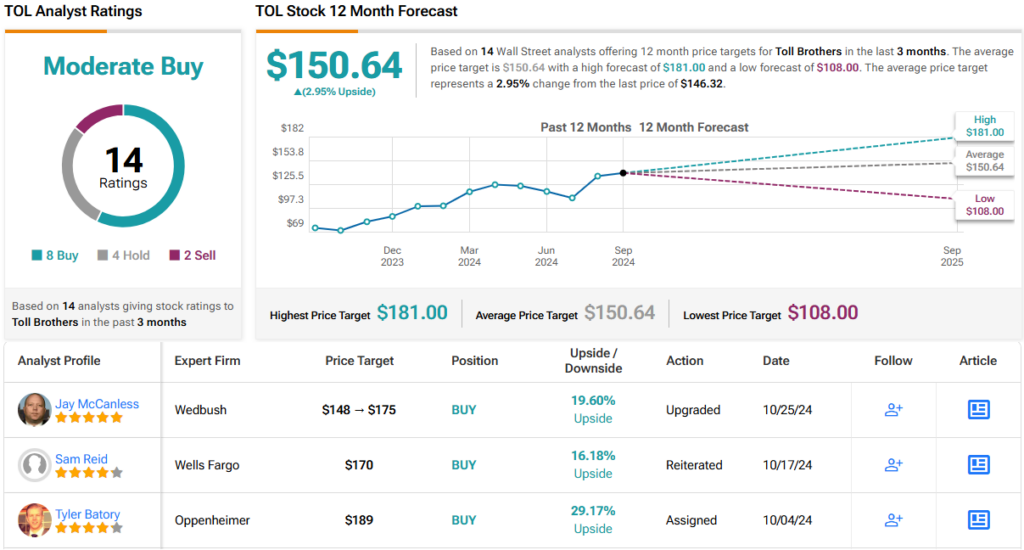

This is more bullish than the Street view. TOL shares have a Moderate Buy consensus rating, based on 14 reviews that split to 8 Buys, 4 Holds, and 2 Sells. The stock is trading at $146.26 and its average target price of $150.64 implies a modest 3% upside from current levels. (See TOL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.