Advanced Micro Devices (AMD) received Buy ratings from Top Wall Street analysts following its $3 billion sale of ZT Systems’ manufacturing business to Sanmina (SANM). The move aligns with AMD’s long-term AI strategy as it retained ZT’s engineering team. Analysts see this as a key step in AMD’s push toward rack-scale AI solutions, making AMD stronger against Nvidia (NVDA).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Back AMD’s AI Strategy with Buy Ratings

Stifel analyst Ruben Roy is bullish on AMD, reaffirming a Buy rating with a $132 price target (16.3% upside). He sees AMD’s sale of ZT Systems as part of its strategy to expand AI infrastructure. Roy believes that ZT’s 1,200 engineers should help speed up AI system development. Also, he noted that AMD’s deal with Sanmina gives it a trusted manufacturing partner for cloud and AI projects, helping AMD stay flexible.

Similarly, Wells Fargo (WFC) analyst Aaron Rakers maintained a Buy rating with a $120 price target (5.7% upside), citing long-term AI potential. The deal bolsters AMD’s rack-scale AI strategy, especially with Instinct MI400-series GPUs coming in 2026. Also, he noted that AMD may use Sanmina as a key manufacturing partner to speed up AI system deployment for cloud customers.

Citi Analyst Sees 12% Downside in AMD Stock

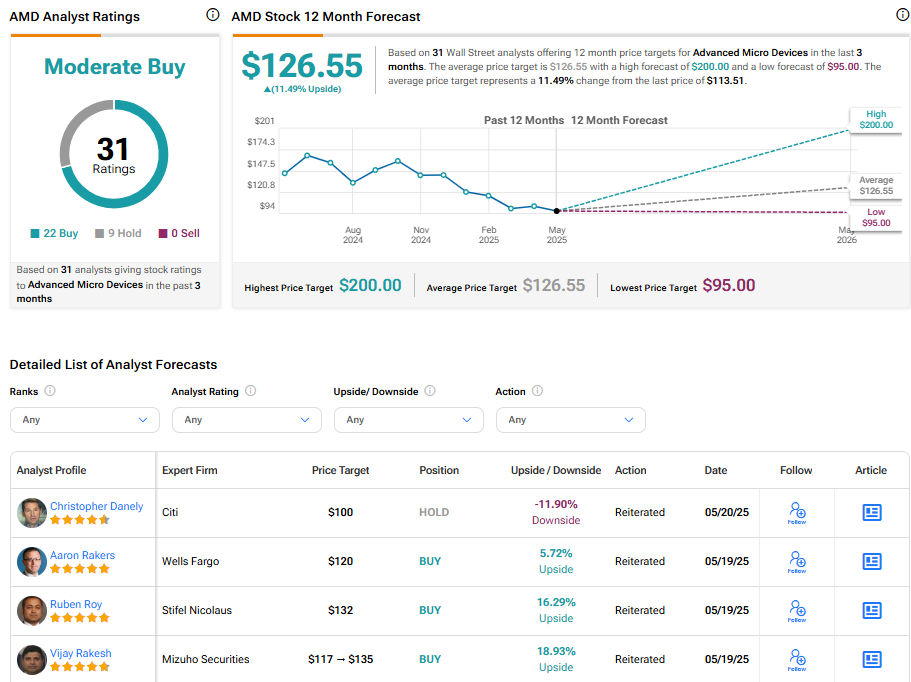

At the same time, a Top-rated Citi (C) analyst, Christopher Danely, assigned a Hold rating to AMD stock, with a price target of $100.

The key factor influencing Danely’s rating is AMD’s ZT Systems sale. Originally, AMD acquired ZT Systems for $4.6 billion. However, AMD sold the manufacturing segment to Sanmina for $3 billion. The sale price was much below Citi’s expected $5 billion.

Nevertheless, Danely expects the deal will help AMD scale in the data center GPU market.

Is AMD a Buy or Sell Now?

Turning to Wall Street, AMD stock has a Moderate Buy consensus rating based on 22 Buys and nine Holds assigned in the last three months. At $126.55, the average AMD price target implies an 11.49% upside potential.