Amazon (NASDAQ:AMZN) is a stock that has been a regular favorite on Wall Street, universally backed by almost all of the analyst community. In fact, until yesterday, only one stock prognosticator maintained a skeptical stance toward the e-commerce giant. However, even that fencesitter has now joined the bull camp.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

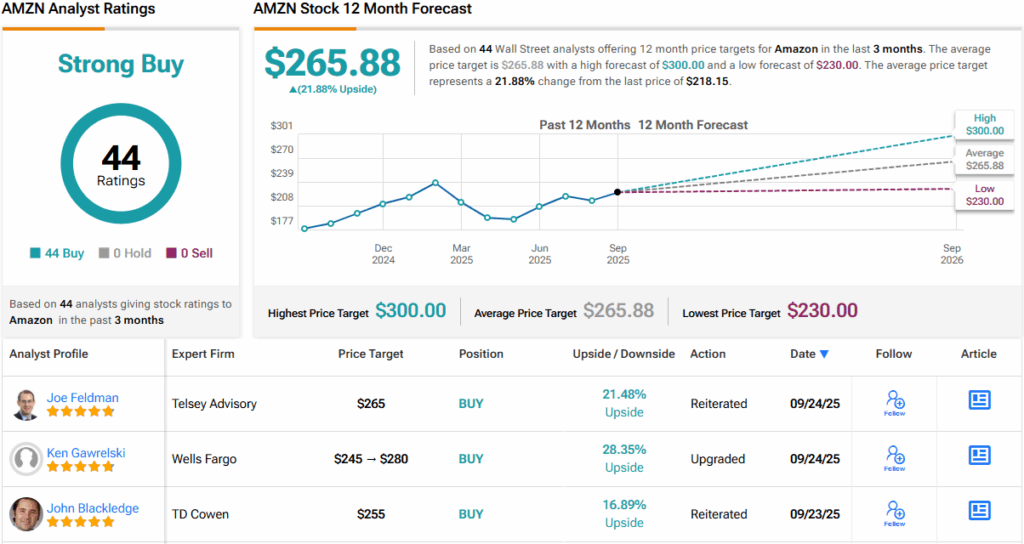

That would be Wells Fargo analyst Ken Gawrelski, who has upgraded his rating on AMZN from Equal Weight (i.e., Neutral) to Overweight (i.e., Buy), while lifting his price target from $245 to $280, suggesting the shares will gain 27% in the months ahead. (To watch Gawrelski’s track record, click here)

Gawrelski now has “greater conviction” that AWS acceleration is in the cards. He raised his revenue growth forecast to 22% in 2026, compared to his prior 19% estimate and ahead of the Street’s 18% consensus. That confidence stems from Project Rainier, a large-scale compute capacity expansion in partnership with Anthropic, which he expects to add meaningful fuel to AWS’s growth engine.

Specifically, Rainier should contribute 5% and 4% to AWS revenue growth in 2026 and 2027, respectively. That’s a timely catalyst, given AMZN shares have underperformed this year – flat against the NASDAQ’s 17% rally. Gawrelski argues the anticipated AWS reacceleration could be the “key to the reversal.”

Reflecting these expectations, the analyst has lifted his 2026 and 2027 AWS revenue estimates by 3% and 7%. Phase 1 of Rainier (1.3GW) is slated to go live in January 2026, followed by a Phase 2 expansion later that year. At full capacity, the Indiana campus (2.2GW) could add roughly $14 billion annually, with Anthropic’s compute usage alone driving seven percentage points of AWS growth in 2026, compared with three points in 2025.

Beyond growth, the outlook also tackles competitive worries. Gawrelski expects AWS’s market share losses will peak in 2025 at -470 basis points before moderating in 2026 and beyond as momentum returns. By 2029, AWS’s share could stabilize at 32% – down from 47% in 2024, but against a market expected to expand at a 31% CAGR to $870 billion, the revenue potential remains substantial.

With that backdrop, Gawrelski joins 43 other analysts in the bull camp, rounding out a Strong Buy consensus rating. The average price target sits at $265.88, pointing to ~22% upside in the year ahead. (See AMZN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.