Intel (INTC) shares have risen in recent weeks, lifted by optimism over new partnerships and funding deals with SoftBank, Nvidia (NVDA), and the U.S. government. But Top HSBC analyst Frank Lee believes the rally has gone too far. In a new report, Lee downgraded Intel to Reduce (Sell) from Hold while raising the price target to $24 from $21.25, still implying about 36% downside from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Intel is set to report its third-quarter earnings on October 23, and HSBC expects results to be broadly in line with estimates, with revenue near $13.1 billion and a gross margin of around 36%. Lee expects gradual improvement through 2026, but said progress will remain slow due to continued weakness in the foundry business.

Why HSBC Is Cautious on Intel Stock

Lee cautioned that Intel’s recent deals, including an $11 billion investment from the U.S. government, a $2 billion investment from SoftBank, and a $5 billion partnership with Nvidia, are positive for visibility but not enough to drive a real turnaround.

“Intel’s own fab execution remains key to any real turnaround,” the analyst said, adding that ongoing manufacturing issues continue to limit the company’s earnings growth.

The analyst also said the Nvidia partnership is unlikely to boost near-term results, as Nvidia is expected to keep using Arm-based CPUs in its main data center systems until at least 2029. “Investors should not expect quick earnings growth from these partnerships,” Lee noted, adding that while the Nvidia deal is positive, its impact will take time to show.

Further, Lee discussed possible partnerships with Taiwan Semiconductor Manufacturing Company (TSM) or Apple (AAPL), but said only a technology-sharing deal with Taiwan Semiconductor (TSM) could meaningfully change Intel’s outlook.

Is Intel a Buy, Hold or Sell?

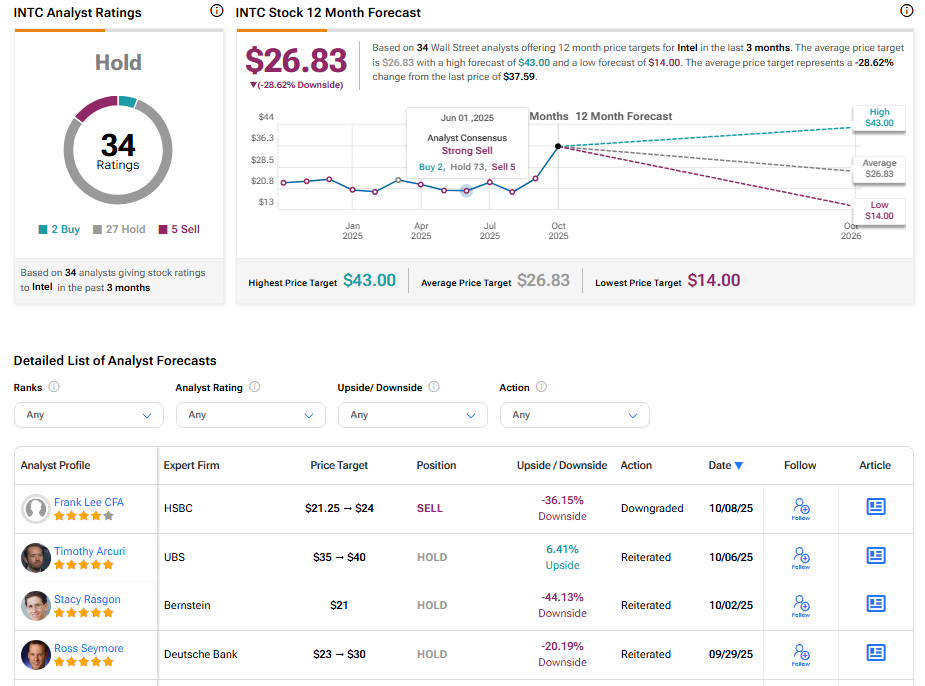

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 27 Holds, and five Sells assigned in the past three months, as indicated by the graphic below. After a 59.55% rally in its share price over the past year, the average INTC price target of $26.83 per share implies a 28.62% downside risk.