Palantir (NASDAQ:PLTR) stock may not yet carry the same name recognition as tech titans like Microsoft, Apple, or Nvidia – but it’s growing by leaps and bounds and edging its way into that elite group. In terms of market cap, Palantir has now broken into the highest echelon of U.S. tech companies, sliding into 10th place.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

But with great hype comes great scrutiny. Some investors believe Palantir’s share price has skyrocketed far beyond its fair value.

One such voice is Stone Fox who calls Palantir’s inclusion in the top 10 “illogical.” The investor notes that the next largest company – Oracle – has quarterly revenues that are 15x those of Palantir.

“The key investor takeaway is that Palantir continues to trade at a wild premium to growth rates, making the stock valuation suddenly a top 10 tech company,” asserts the 5-star investor.

According to Stone Fox, the real challenge for new investors isn’t just justifying today’s price – it’s betting on an even loftier future. To make the math work, the stock would need to hit $150 within a year and climb to $200 within three. Anything short of that, and the premium valuation starts to look more like wishful thinking.

Another issue is the large amount of stock-based compensation (SBC) that Palantir uses to reward company executives. The investor points out that Palantir’s share count rose by 155 million shares last year (worth $19 billion), representing a significant amount of shareholder dilution.

“Investors should use this signal to dump the stock,” concludes Stone Fox who rates PLTR shares a Sell. (To watch Stone Fox Capital’s track record, click here)

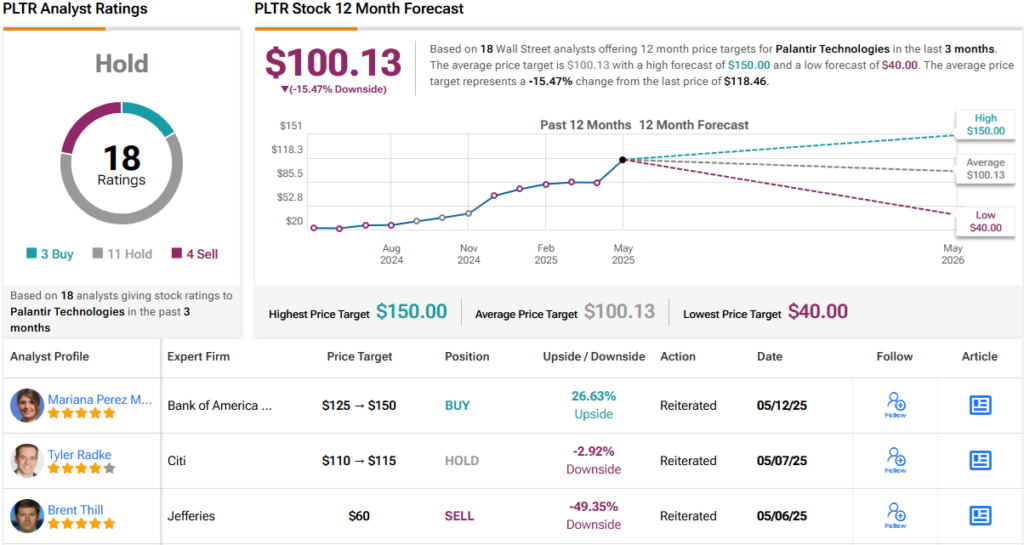

Wall Street, for its part, isn’t exactly jumping on the bullish bandwagon either. With 11 analysts calling PLTR a Hold, 4 recommending Sell, and only 3 issuing Buy ratings, the stock sits squarely in Hold (i.e., Neutral) territory. The average price target of $100.13 implies a ~15% drop from where the stock currently trades. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.