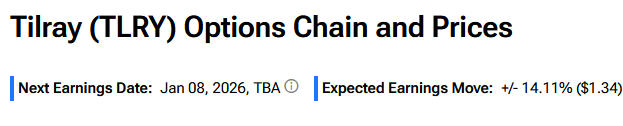

Cannabis company Tilray (TLRY) is scheduled to announce its results for the second quarter of Fiscal 2026 after the market closes on Thursday, January 8. TRLY stock has risen 29% over the past month as U.S. President Donald Trump signed an executive order to reclassify cannabis from a Schedule I substance to a Schedule III substance. However, the stock is still down 35% over the past year due to profitability concerns. According to TipRanks’ Options Tool, options traders expect about a 14.11% move in either direction in TLRY stock in reaction to Q2 FY26 results.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This implied move is lower than TLRY stock’s average post-earnings move (in absolute terms) of 17.78% over the past four quarters.

Wall Street expects Tilray to report a loss per share of $0.21 for Q2 FY26, with revenue expected to be flat at $210.9 million.

Investors await updates from management on the company’s growth strategy amid an improving regulatory backdrop in the U.S. Meanwhile, Tilray has been pursuing growth in recent years through strategic acquisitions and expansion into the craft beer market.

It is worth noting that, despite the reclassification, cannabis remains illegal in the U.S. at the federal level.

Bernstein Analyst’s Views on TLRY Stock

Following the signing of the executive order on cannabis reclassification, Bernstein analyst Nadine Sarwat increased the price target for Tilray to $10 from $1 while maintaining a Hold rating. The analyst highlighted that the executive order would require developing a regulatory framework for CBD (cannabidiol) products and increasing research. “Our coverage companies are positioned differently to benefit from the regulatory change, but it is not clear if any would be long-term winners,” said Sarwat.

The analyst noted that following the signing of the executive order, Tilray announced the formation of Tilray Medical USA to leverage its experience in the medical cannabis space to win opportunities in the U.S. market.

TipRanks’ AI Analyst Is Cautious on Tilray Stock Ahead of Q2 Earnings

Heading into Q2 FY26 earnings, TipRanks’ AI Analyst has a Neutral rating on Tilray stock with a price target of $12, indicating 26.4% upside potential. The AI Analyst’s cautious stance is based on the company’s weak financial performance, with significant losses and liquidity issues. While the Q1 FY26 earnings call provided some positive insights into revenue growth and strategic initiatives, TLRY stock’s valuation remains a concern, given its negative price-to-earnings multiple. The AI Analyst noted that Tilray’s ability to address profitability and cash generation will be vital for future improvement.

Is TLRY Stock a Good Buy?

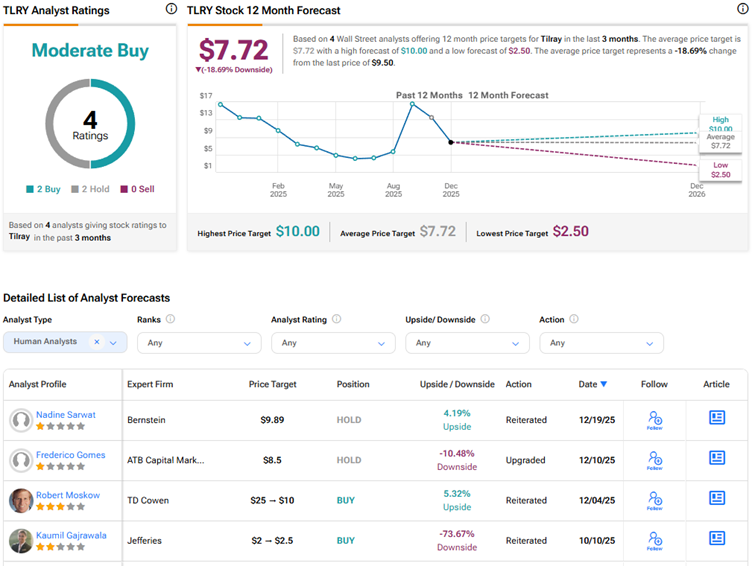

Currently, Wall Street has a Moderate Buy consensus rating on Tilray stock based on two Buys and two Holds. The average TLRY stock price target of $7.72 indicates a downside risk of about 19% from current levels.