Shares of Tilray, Inc. (TLRY) rose 2.1% to close at $11.02 on Thursday after the global cannabis-lifestyle and consumer packaged goods company met first-quarter Fiscal 2022 loss estimates. The company, however, missed analysts’ expectations on the revenue front.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

TLRY reported a loss of $0.08 per share in the first quarter, in line with the consensus estimate. Results compare favorably with the loss of $0.09 per share recorded in the same quarter last year.

Additionally, revenues surged 43% year-over-year to $168 million, but still disappointed by missing analysts’ expectations of $177.92 million.

Segment-wise, the company’s cannabis revenue jumped 38% year-over-year, while distribution revenue grew 1.4%. Additionally, net beverage alcohol revenue came in at $15 million following the SweetWater acquisition last year, and wellness revenue stood at $15 million from Manitoba Harvest. (See Tilray stock charts on TipRanks)

Recording the tenth consecutive quarter of positive adjusted EBITDA, Tilray reported adjusted EBITDA of $12.7 million in the quarter, up 58% year-over-year.

Markedly, the company achieved cost-saving synergies of $55 million on a run-rate basis year-to-date, with actual cash savings near to $20 million. The company said it was on track to achieve at least $80 million in cost-savings from Aphria and Tilray business combination synergies.

See Top Smart Score Stocks on TipRanks >>

Following the results, Tilray CEO Irwin D. Simon commented, “Tilray’s first quarter 2022 results affirm that, amid the paradigm shift towards global cannabis legalization, we are unquestionably executing against two key objectives. The first is maximizing near-term profitability through leadership in both higher-margin international medical markets and in Canada…The second objective is to fully realize the promise and potential of Tilray by capitalizing on the nearly $200 billion global cannabis market opportunity.”

In response to the first-quarter results, Cantor Fitzgerald analyst Pablo Zuanic reiterated a Buy rating and a price target of $18 (63.3% upside potential) on the stock.

Fitzgerald said, “Looking forward, we see several positives: cost synergies are ahead of plan, the company is innovating across the domestic recreation and medical portfolio, it claims good momentum in the export markets, and M&A will remain part of the story.”

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 3 Buys and 8 Holds. The average Tilray price target of $16.13 implies 46.4% upside potential to current levels. Shares have increased 79.2% over the past year.

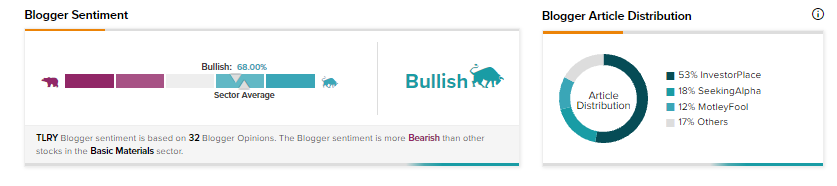

Bloggers are also enthusiastic about Tilray. TipRanks data shows that financial blogger opinions are 68% Bullish on TLRY, compared to a sector average of 72%.

Related News:

EMA Approves Moderna’s Third Dose of COVID-19 Vaccine

SunPower Snaps Up Blue Raven Solar for $165M

Boston Scientific Inks $1.75B Deal to Acquire Baylis Medical