China’s commerce ministry stated regarding TikTok’s ongoing U.S. saga that it hopes companies can reach solutions that comply with Chinese law while balancing the interests of all parties involved. The comment came after progress on TikTok’s long-planned U.S. deal.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

At the same time, China called on the U.S. to offer a fair and open business setting for Chinese firms. In this context, officials said both sides should work toward steady and lawful outcomes.

Last week, TikTok signed a binding U.S. deal, as Oracle (ORCL) steps in as Key Partner. TikTok, the short-video platform owned by China’s ByteDance, has moved forward with its U.S. separation plan, according to the reports. The company said it signed binding agreements to form a new U.S.-based venture that will be owned mainly by American investors, according to an internal memo from Chief Executive Shou Chew.

Oracle Leads the U.S. Investor Group

Oracle Corporation is part of the buyer group, and the deal is set to close on January 22, 2026, pending final approvals. As a result, Oracle plays a central role in the new setup.

According to the memo, more than 50% of TikTok U.S. investors will be new. The group is led by Oracle, private equity firm Silver Lake, and Abu Dhabi-based MGX, with each holding a 15% stake.

In addition, affiliates of current ByteDance investors will own 30.1%. ByteDance will keep a 19.9% stake. Therefore, the structure cuts ByteDance control but does not remove it fully.

Is ORCL Stock a Good Buy?

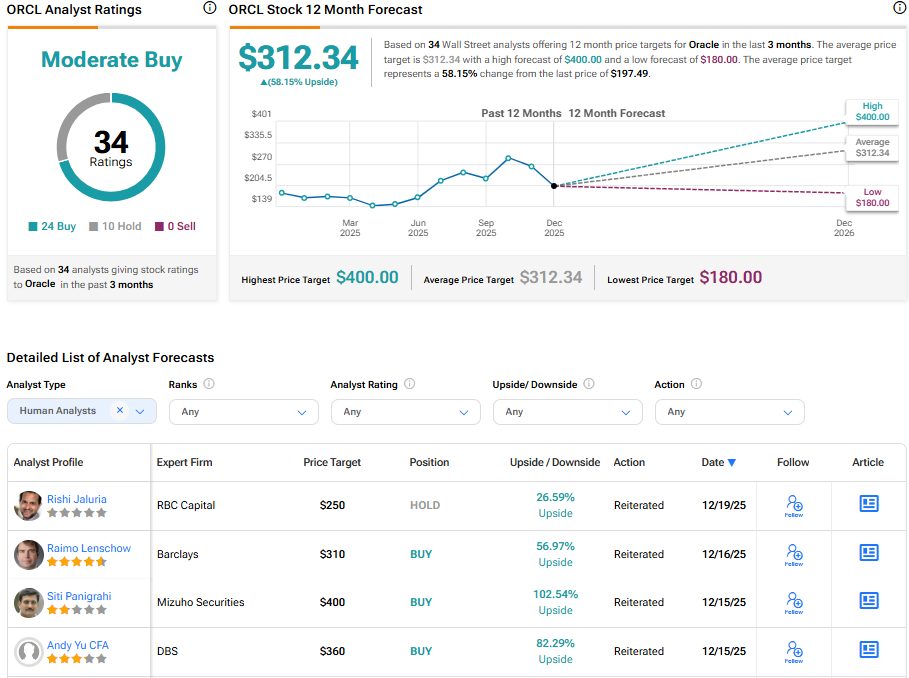

Turning to the Street, Oracle holds a Moderate Buy consensus, with an average ORCL stock price target of $312.34. This implies a 58.15% upside from the current price.