Amid tariffs and policy shifts, 2025 turned into a challenging year for U.S. electric vehicle makers. Tesla (TSLA), Rivian Automotive (RIVN), and Lucid Group (LCID) all faced slower sales, higher costs, and more pressure from policy changes. At the same time, each company pushed ahead with new plans tied to AI, autonomy, and future growth.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Overall, the EV market felt the impact of the Trump administration’s rollback of EV support. The $7,500 federal EV tax credit ended, fuel rules were revised, and penalties for gas-heavy fleets were removed. As a result, demand weakened across the industry, even as long-term interest in EVs remained steady.

Tesla Holds Its Value as Sales Slip

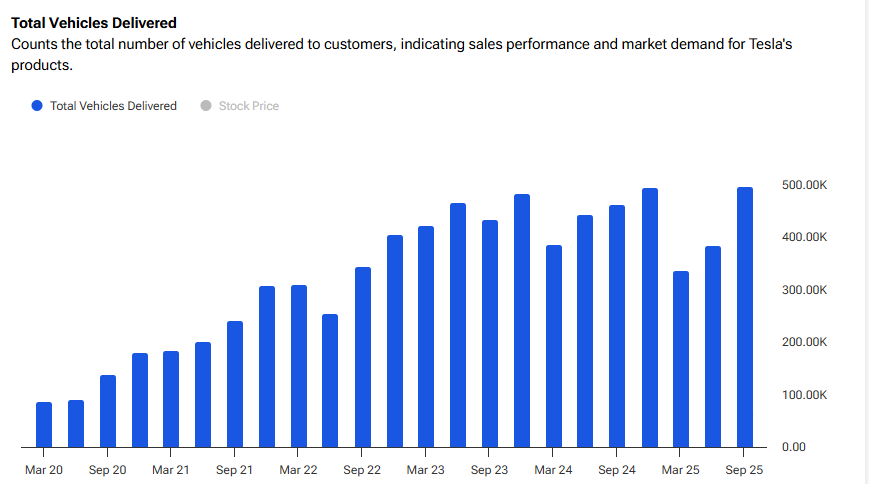

Tesla spent most of 2025 under a sales cloud. During November, U.S. sales fell by about 23%. In Europe, October sales dropped by about 48.5%. China sales also slowed, with Tesla selling more than 125,000 fewer vehicles year over year.

For the first three quarters of 2025, Tesla delivered about 1.21 million vehicles. That marked a near 6% decline from the same period last year. Meanwhile, newer models delivered mixed results. The refreshed six-seat Model Y L sold well in China and may expand into Europe. However, the Cybertruck failed to meet early hopes, despite heavy promotion.

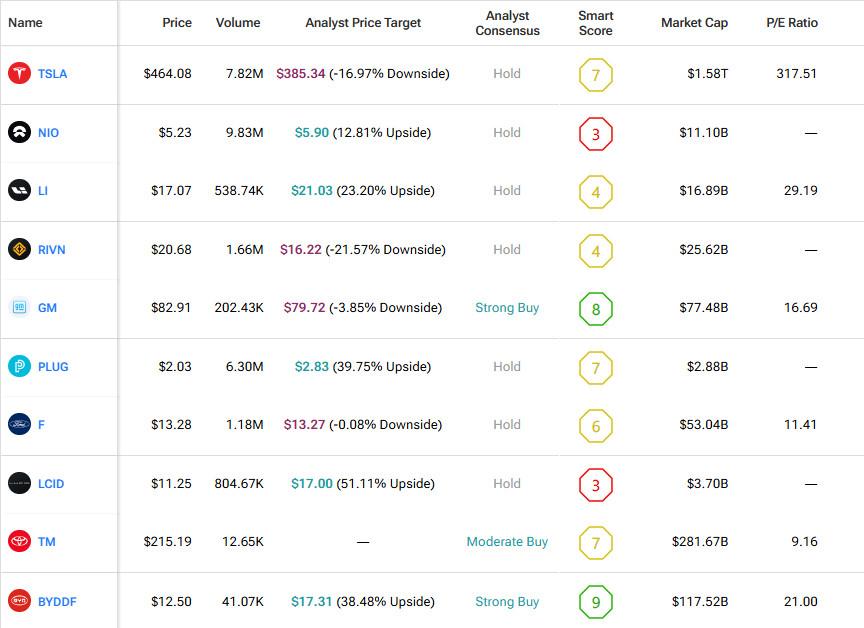

Still, Tesla’s stock story stayed strong. The company remains the most valuable automaker in the world, with a market value above $1.6 trillion. That figure is higher than Toyota Motor (TM), BYD (BYDDF), Ford Motor (F), and General Motors (GM) combined.

At the same time, Tesla increased its focus on AI and autonomy. Robotaxi testing expanded in Austin, and Tesla registered more than 1,600 vehicles for ride-hailing use in California. The company now targets Robotaxi launches in 8 to 10 large cities.

However, legal pressure increased when California regulators ordered a brief pause in Tesla vehicle sales due to claims about Full Self-Driving. Tesla also faced several lawsuits tied to past crashes. Even so, investors approved Elon Musk’s pay plan, which boosted his ownership stake.

Rivian and Lucid Face Scale Tests

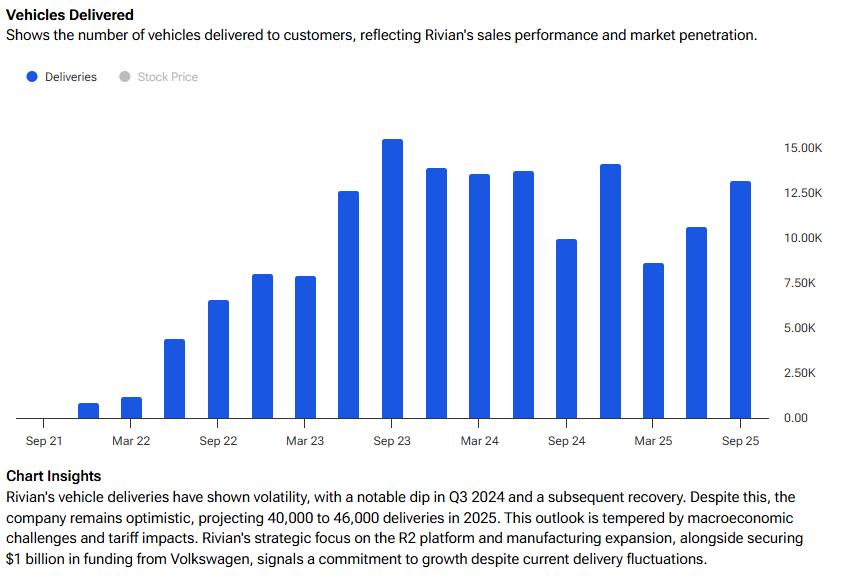

Rivian delivered a more balanced year. In the third quarter, the company delivered 13,702 vehicles across its R1S and R1T models. Earlier this year, Rivian warned that tariffs could increase build costs. Still, the company broke ground on a new factory in Georgia. This site is key for the lower-priced R2 crossover due next year.

Furthermore, Rivian outlined a new CEO pay plan tied to profit and stock goals. The full value could reach $4.6 billion over ten years if targets are met. Rivian also rolled out hands-free driving tech that uses LiDAR and will be sold through a monthly plan or a one-time fee.

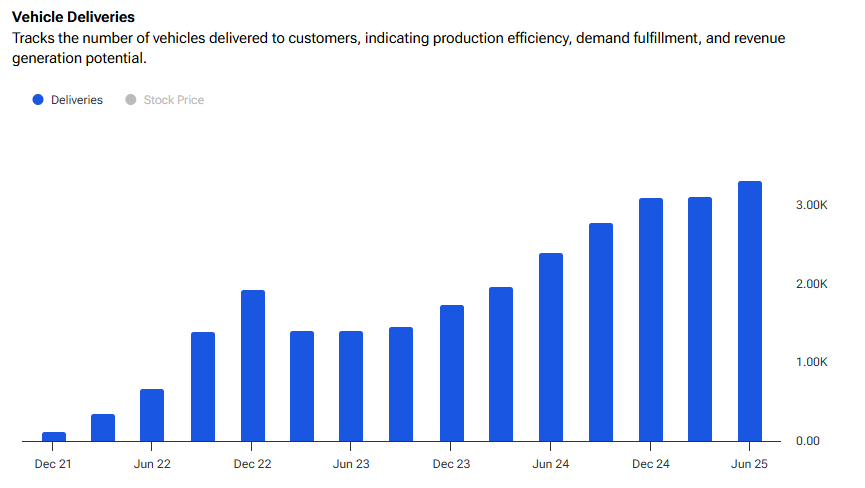

Lucid saw both highs and lows. The company posted a record third-quarter delivery total of 4,078 vehicles. It also built extra vehicles for Saudi Arabia. However, Lucid cut its full-year build outlook to 18,000 to 20,000 vehicles.

Looking Ahead

As 2026 nears, the U.S. EV sector remains in transition. Tesla is leaning harder into AI and autonomy. Rivian is focused on cost control and scale, while Lucid is aiming to stabilize output and demand. 2025 tested the industry, with each company continuing to chase long-term growth in a changing market.

We used TipRanks’ Comparison Tool to line up all the companies appearing in the piece. It’s a great way to gain an in-depth look at each stock and the EV industry as a whole.