CuriosityStream (CURI) isn’t your typical streaming giant, but this year, it’s been one of the market’s biggest surprises. The stock has soared 303% year-to-date, leaving the S&P 500 (SPY) and most of its media peers in the dust.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s Behind the Surge?

Financial momentum. CuriosityStream just posted its first-ever net profit, alongside record Q1 revenue of $15.1 million, up 26% from last year. Free cash flow was positive for the fifth quarter in a row, and the company doubled its dividend to $0.32 annually, adding a sweetener for shareholders.

Better yet, CuriosityStream has zero debt and $39 million in cash on the books. That clean balance sheet gives CuriosityStream the flexibility to grow without relying on loans. This niche streamer focuses on nonfiction content—think science, history, and tech documentaries—delivered via subscriptions, licensing deals (with platforms like Amazon (AMZN) and Roku (ROKU)), and a growing list of partnerships.

But it’s not all smooth sailing.

Direct subscriptions have dipped slightly, and rising content costs are starting to bite. Plus, the company still carries a negative P/E ratio, meaning it’s not yet consistently profitable. Still, technical indicators point to a strong uptrend. The stock is trading well above its moving averages, and despite some signs of overheating, momentum remains largely bullish.

What Spark Says About CURI

Our AI analyst, Spark, rates the stock 66/100, neutral overall but trending positive, highlighting solid balance sheet strength, improving cash flow, and operational progress. Risks include pricing pressure, cost management, and potential content write-downs.

With a market cap of just $344 million, CuriosityStream is still a small fish. But its 2025 rally proves that focused strategy, clean finances, and disciplined execution can still capture investor attention.

The bottom line is that CuriosityStream isn’t trying to be the next Netflix (NFLX). But in its own lane, it’s delivering—and perhaps it’s a good time for investors to tune in.

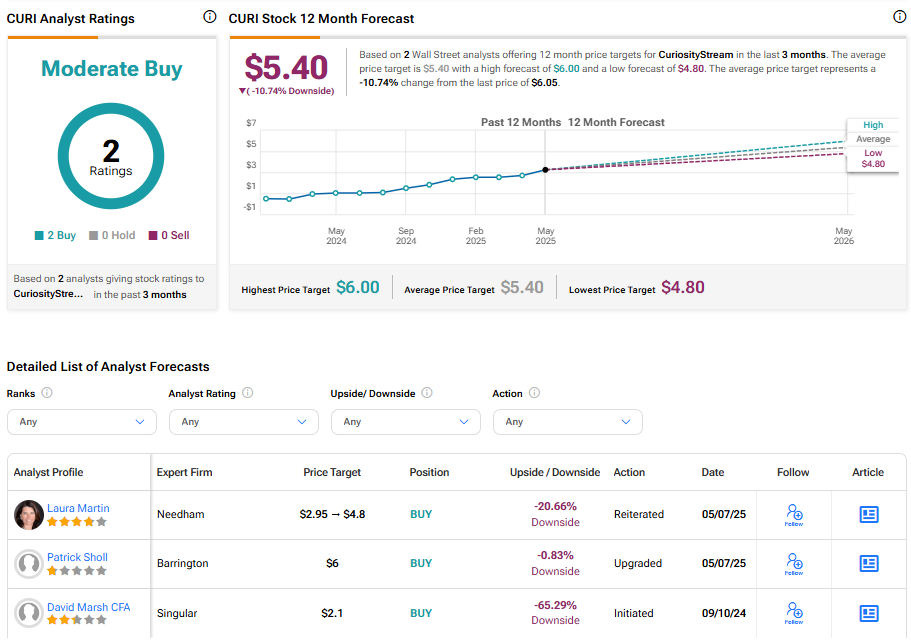

Is Curi Stock a Good Buy?

On the Street, analysts rate CuriosityStream as a Moderate Buy, with an average CURI stock price target of $5.40. This implies a 10.74 downside.