In a volatile market, dividend stocks offer investors a sense of stability. Beyond generating passive income, companies with a strong track record of increasing dividends often follow disciplined capital allocation strategies, helping them navigate economic uncertainty. In this context, U.S.-based tanker fleet operator International Seaways (INSW), a Russell 2000 Index member, stands out with an impressive 17.56% dividend yield. Additionally, analysts are highly bullish on INSW stock, assigning it a Strong Buy rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Russell 2000 Index tracks 2,000 small-cap U.S. companies, serving as a key benchmark for the sector.

TipRanks Makes Dividend Investing Easier

TipRanks offers various tools to help users find and track dividend stocks that match their preferences. The Best Dividend Stocks list highlights top dividend-paying companies in Australia with key comparison metrics. Additionally, the Dividend Calendar makes it easy to monitor upcoming payouts, allowing investors to buy shares in time to qualify for the next distribution.

Let’s take a closer look at International Seaways.

International Seaways’ Dividend History

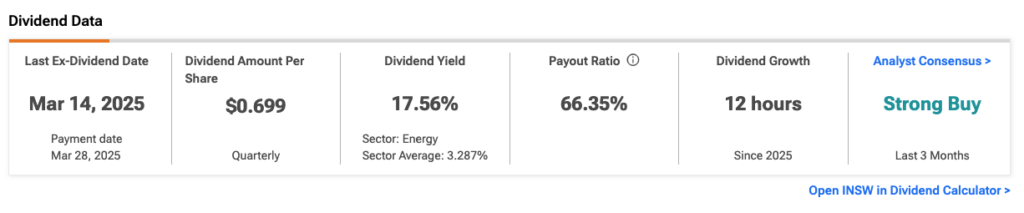

International Seaways is engaged in the transportation of crude oil and petroleum products globally. The company pays quarterly dividends, totaling four per year. It currently offers an impressive dividend yield of 17.56%, significantly higher than the sector average of 3.29%. The next dividend payment of $0.70 per share, scheduled for March 28, includes a regular dividend of $0.12 and a supplemental payout of $0.58. This represents 77% of adjusted net income for the fourth quarter.

The company pays solid dividends due to its robust cash flow generation, driven by its disciplined capital allocation. Additionally, its fleet of modern, fuel-efficient vessels enables it to capitalize on global energy transportation demand, ensuring steady earnings. In 2024, the company delivered another strong year, returning over $300 million to shareholders primarily through dividends for the second consecutive year. Notably, it paid $5.77 per share in combined dividends throughout the year.

Looking ahead, the company stated it is in a strong position to invest in its fleet, uphold financial stability, and continue returning value to shareholders. In 2024, it converted term loans into revolving credit, saving over $80 million annually in mandatory debt payments and boosting its free cash flow.

Is International Seaways a Good Stock to Buy?

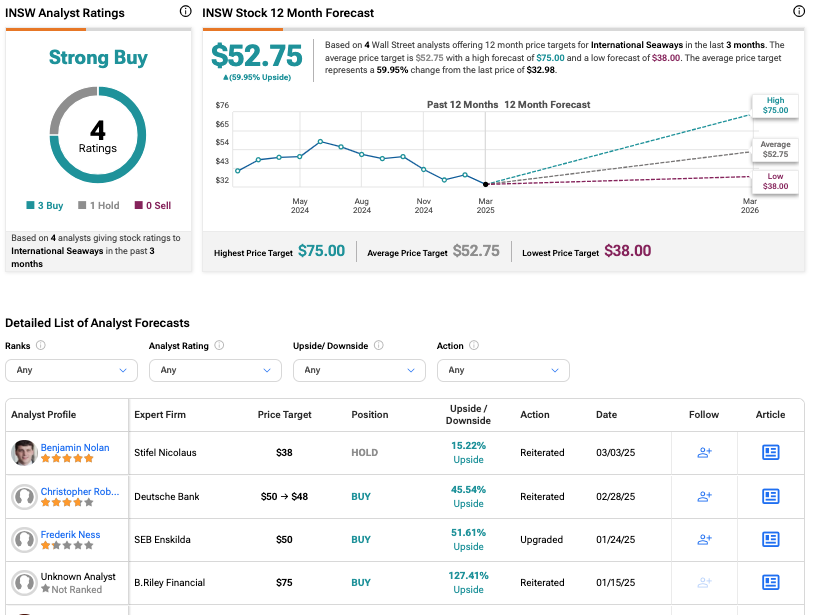

INSW not only provides steady dividends but also holds strong share price growth potential. On TipRanks, INSW stock has a Strong Buy rating, supported by three Buy and one Hold recommendation. The International Seaways average price target of $52.75 suggests a potential 60% upside from current levels.