UnitedHealth (UNH) shares plunged at the time of writing after The Guardian published a report accusing the Health insurance company of making secret payments to nursing homes in order to limit hospital transfers. The article claims these alleged cost-cutting tactics saved UnitedHealth millions but may have put patients’ health at risk. The accusations come as the company is already dealing with several issues, including a major cyberattack on its Change Healthcare unit and ongoing investigations into possible Medicare fraud.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

In response to the report, UnitedHealth strongly denied the claims by stating that the U.S. Department of Justice (DoJ) had already investigated the matter. The company said that the DoJ interviewed witnesses, reviewed thousands of documents, and found “significant factual inaccuracies” in the allegations. As a result, after a multi-year investigation, the DoJ chose not to take any legal action. Nevertheless, investors remain cautious, as the stock has fallen over 39% this year, which is far worse than the Dow’s slight 0.6% decline.

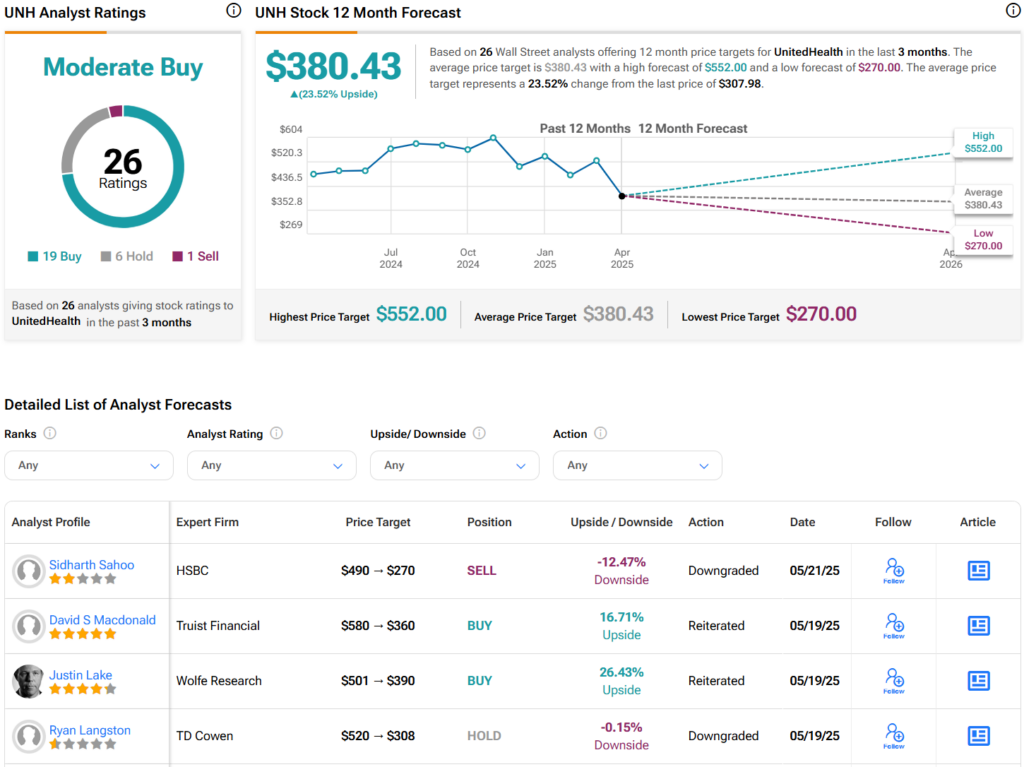

Indeed, HSBC downgraded the stock to Sell and cut its price target to a street-low of $270 due to rising medical costs, drug pricing pressures, challenges at its OptumRx pharmacy unit, and possible Medicaid funding cuts. Interestingly, though, with the sudden departure of CEO Andrew Witty, the company is now leaning on former CEO Stephen Hemsley to help lead it through the crisis. It is worth noting that many, including Novare Capital Management’s James Harlow, believe Hemsley has the experience needed to rebuild trust and stabilize the company.

What Is the Future of UNH Stock?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on UNH stock based on 19 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average UNH price target of $380.43 per share implies 23.5% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue