Guardant Health (GH) stock soared 30% today after the precision oncology company delivered a stellar third-quarter earnings report and raised its full-year revenue guidance. The rally reflects growing investor optimism about the company’s cancer screening and biopharma businesses, as well as its path to profitability.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Revenue Jumps 39%

Guardant Health posted a strong Q3 performance, with revenue up 39% year-over-year to $265.2 million. Segment-wise, Oncology revenue grew 31% to $184.4 million, driven by a 40% increase in test volume, while Shield screening revenue came in at $24.1 million, reflecting growing demand for early cancer detection.

Importantly, the company achieved positive free cash flow in its core business one quarter ahead of schedule.

Coming to the bottom line, the company reported a net loss of $0.74 per share compared with analysts’ expectations of a loss of $0.79.

Guidance Raise Fuels Optimism

Guardant Health lifted its full-year revenue guidance to a range of $965 million to $970 million, up from the prior range of $915 million to $925 million. The new guidance represents an annual growth of nearly 31%.

The upbeat outlook signals continued strength across its oncology, screening, and biopharma businesses.

UBS Analyst Assigns New Street-High Price Target

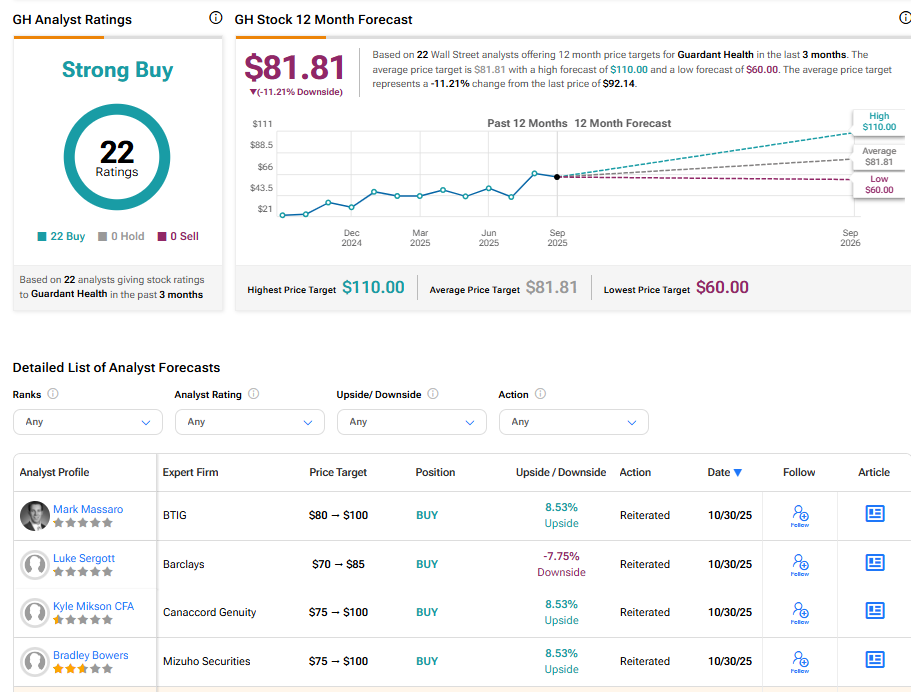

Following the news, UBS analyst Dan Leonard raised Guardant Health’s price target to a new Street-high of $110 (19.4% upside) from $80 and kept a Buy rating. After another strong quarter, the Top analyst sees several growth drivers ahead for the company.

Is GH Stock a Good Buy?

Currently, Wall Street has a Strong Buy consensus rating on GH stock based on 22 unanimous Buys assigned in the past three months. The average Guardant Health stock price target of $81.81 indicates an 11.21% downside risk from current levels.