Archer Aviation (ACHR) saw its stock swing sharply this week after speculation of a partnership with Tesla (TSLA) first sent its stock soaring, only for excitement to fade after Tesla’s announcement left out any mention of the air taxi maker. Indeed, Archer’s shares jumped nearly 34% between Friday and Monday after the company released a video showing its “Midnight” aircraft alongside Tesla’s cars and Optimus robot. This created hopes that Tesla might enter the flying car market through Archer, either with a partnership or even an acquisition.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla added fuel to the speculation when it posted a teaser clip on X showing a spinning turbine-like image with its logo, which hinted at a major reveal on October 7. Many investors linked this to Archer, expecting Tesla to confirm its involvement in eVTOL technology. Instead, Tesla used the event to introduce cheaper versions of the Model 3 and Model Y, with no mention of Archer. As a result, shares of Archer fell 8.6% on Tuesday.

Nevertheless, Archer has made meaningful progress on its own. In fact, the company has secured partnerships with United Airlines (UAL) and will serve as the exclusive air taxi provider for the 2028 Los Angeles Olympics. It is also working toward an FAA type certification, which is a key step before commercial operations can begin. While Tesla speculation created short-term volatility, Archer’s ability to hit these milestones and move closer to generating revenue is more important for its future.

Is ACHR Stock a Good Buy?

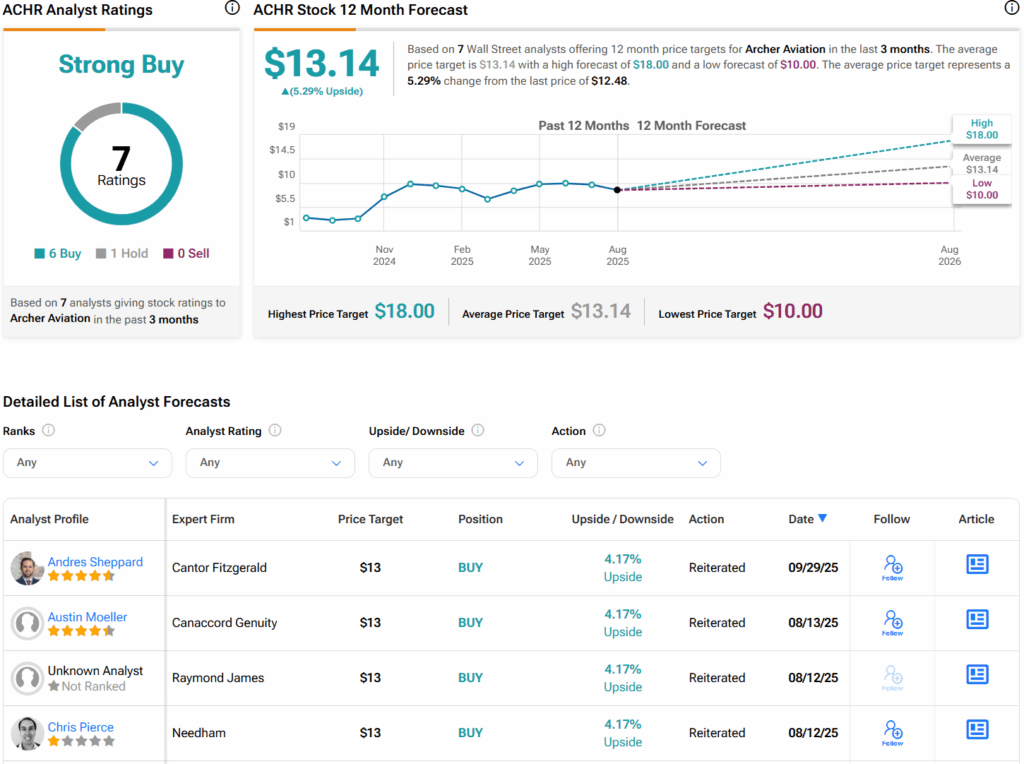

Turning to Wall Street, analysts have a Strong Buy consensus rating on ACHR stock based on six Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average ACHR price target of $13.14 per share implies 5.3% upside potential.