OpenAI’s (PC:OPAIQ) aggressive push to build up to $1 trillion in AI-related systems has intensified the scrutiny on the so-called hyperscalers: Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Amazon (AMZN). These tech giants, which are all reporting earnings this week, are under pressure to show how their capital expenditures are funding their AI strategies without scaring off investors. Despite having different core businesses, Wall Street is laser-focused on spending, which is the result of the limited supply of computing power and energy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Indeed, OpenAI and the hyperscalers are working to build large-scale data centers that are often powered by Nvidia (NVDA) chips to support AI growth. They’re also teaming up with companies like Oracle (ORCL) and Broadcom (AVGO). However, because investors can react negatively to high spending without clear returns, companies must balance their AI projects with financial responsibility. Notably, total capex among these firms could hit $550 billion in 2026, according to Morgan Stanley, rising by 24% from the previous year. However, it’s still unclear how profitable these investments will be.

In addition, each company has its own approach. For example, Microsoft plans to spend $91.3 billion this year, up 42%, but expects growth to slow down afterward. Meanwhile, Alphabet raised its 2025 target to $85 billion and may raise it again due to a chip deal with Anthropic (PC:ANTPQ). At the same time, Meta now expects to spend $69 billion to focus on using AI to improve ads and engagement, while Amazon tops the list at $117 billion, as it mainly invests in cloud and AI chips.

Which AI Stock Is the Better Buy?

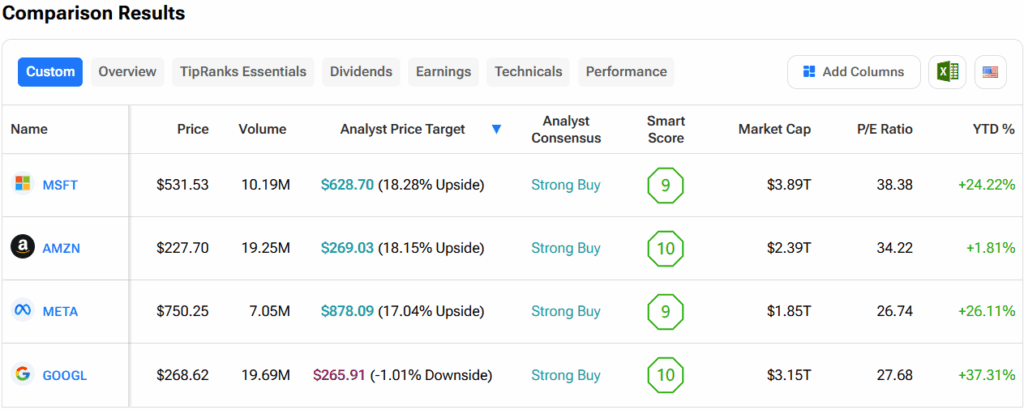

Turning to Wall Street, out of the four stocks mentioned above, analysts think that MSFT stock has the most room to run. In fact, MSFT’s average price target of $628.70 per share implies more than 18% upside potential. On the other hand, analysts expect the least from GOOGL stock, as its average price target of $265.91 equates to a loss of 1%.