Boeing (NYSE:BA) stock has managed to soar above the turbulence in 2025, gaining 9% year-to-date, while the S&P 500 is still down 3%.

A key reason behind this outperformance came late last month, when the company delivered a solid Q1 earnings report that reignited investor confidence. Boeing reported a 56.6% increase in commercial aircraft deliveries (130 in total) year-over-year and unveiled a robust order backlog worth $545 billion in future sales, a figure that should offer a healthy buffer against potential trade-related headwinds.

That buffer may prove especially important given Boeing’s exposure to the global trade environment. The company is certainly not immune from the deleterious effects of a meltdown in global commerce, with the U.S.-China trade spat of particular concern. Just last month, in a direct response to the threat of 145% American tariffs on Chinese goods, China put a halt on the delivery of Boeing-manufactured jets to its domestic airlines.

Despite becoming a chit in the high-stakes game of international trade negotiations, top investor Dhierin Bechai foresees a scenario in which Boeing plays a constructive role in ending the ongoing drama.

“If history is an indicator, the US and China will come to terms and Boeing airplane deliveries will be pivotal,” says the 5-star investor, who sits in the top 2% of TipRanks’ stock pros.

Bechai points out that aerospace is one of the few sectors where the U.S. enjoys a trade surplus – and Boeing is the key driver of that edge. In short, the company isn’t just a pressure point in the dispute, it could serve as a bridge between the two sides.

“Boeing plays an extremely big role, probably the biggest in the US, in narrowing the trade deficit,” Bechai emphasizes.

Furthermore, the investor notes that demand for commercial airplanes is outpacing supply around the world, ensuring that Boeing should have no issue finding other buyers. This has already been the case, with Air India, Malaysia Airlines, and Riyadh Air all interested in purchasing planes that had been previously bound for China.

While the dangers of a larger breakdown in international trade still pose a risk to BA, Bechai is confident that Boeing will emerge on the other side in good shape.

“I do believe that while signs of the trade war intensifying will increase stock price volatility, the longer-term outlook remains positive,” concludes Bechai, who rates Boeing shares a Buy. (To watch Dhierin Bechai’s track record, click here)

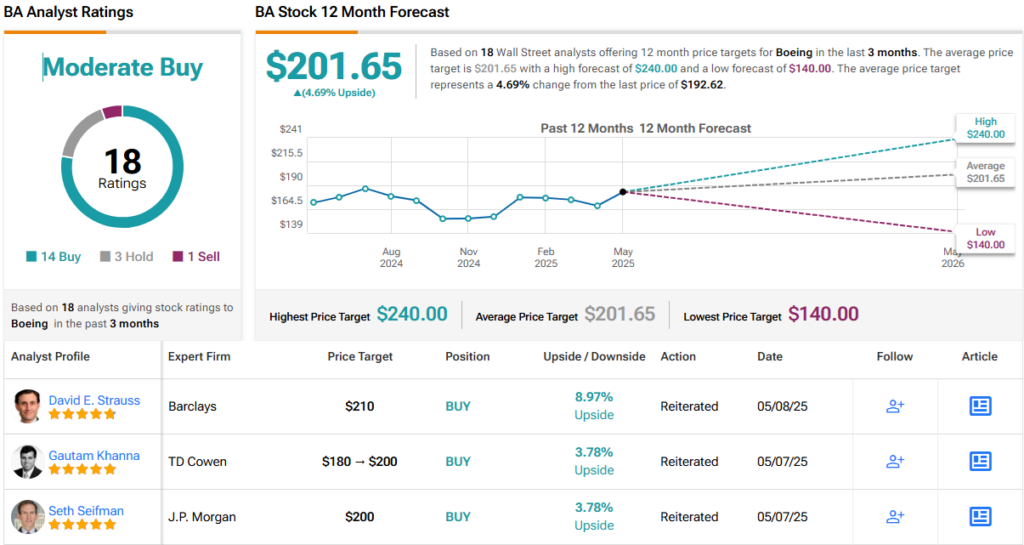

That perspective is broadly reflected across Wall Street. Boeing holds a Moderate Buy consensus rating, supported by 14 Buy, 3 Hold, and 1 Sell recommendations. Yet, the average 12-month price target stands at $201.65, implying a potential upside of a modest ~5%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.